Best Credit Card Reader for AndroidIn the era of the digital world, most people are using credit cards for making business transactions and shopping with them. Keeping this point in mind, merchants are looking for credit card readers for Android and iPhone to take card payments. Accepting credit cards with mobile phones helps serve more customers and increase your business revenue. A good mobile point-of-sale (POS) app and smartphone can even use credit card processing.  If you are using an Android smartphone and looking for a credit card reader to accept card payments, we are here to help you. This article illustrates the best credit card reader for Android smartphones. Before you select a credit card reader, ensure some important points to accept cards with your Android phone. The requirement to accept credit cards with Android smartphones and tablet

Once you install the app and connect it to the card reader, you can accept your first card payment. Types of Credit Card ReadersBefore you start purchasing and setting up your credit card reader, make sure what type of credit card reader you are looking for. There are a few different types of credit card readers available. So, you should first know their features and choose the one that best suits your business. The three most commonly used types of card readers are: Magnetic Stripe Readers Magnetic stripe readers are the most basic type of card reader, and they are mainly available at a very low-cost price. The reader device requires you to swipe the customer's credit card through the reader to make a payment. EMV Chip Readers EMV Chip Readers credit card reader devices are the next step up and are becoming more common. This reader device requires customers to insert a credit card to make payments. NFC Readers NFC-type card (credit and debit) readers are advanced card readers that allow customers to process payments without swiping or inserting the card. They can only hold the card near the device to make payment. Now we will illustrate some of the best credit card readers for Android that help you to choose for your need. Best Credit Card Readers for Android

Square Reader: Best for all-around value Square Reader is one of the best credit card reader devices for Android smartphones. It is compatible with devices running on Android 4.0 and higher versions, and it doesn't charge any monthly fee. Square's business services ecosystem is growing, including a point-of-sale (POS) system. It is accessible and works for a complete retail store, smaller businesses, and casual users. The key feature of Square Reader includes the prevention of active fraud and dispute management. There are no monthly fees, and the minimum use charges make it attractive among casual users. One of its unique services is it charges the same rate no matter which card the customer uses. Monthly fee: $0 Transaction charges

Card reader cost for Android

Pros

Cons

Download the Square app from Google Play Store. SumUp: Best for small businesses on a budget SumUp is another popular credit card reader that is best for small businesses on a budget. It is an inexpensive Android-friendly credit card reader with a low processing rate and no monthly fee. The hardware cost it supports starts at $35, and processing fees start from 2.75% per transaction. SumUp is easy to access; sign up in a few minutes and start accepting card payments in person, online payment, and on the go. SumUp is a convenient and best-class credit card reader that receives transaction funds on the next business day. It accepts and supports credit and debit, gift cards, invoice payments, etc. If you are a low-volume smaller seller business, you can try this straightforward mobile processing payment option. Monthly fee: $0 Transaction charges

Card reader cost for Android

Pros

Cons

Download the SumUp app from Google Play Store. PayPal Zettle: Best for restaurants PayPal Zettle is a reliable mobile card reader with great features such as a PIN pad for processing, instant battery charging, etc. It is an easy solution if you want your business funds to transfer through the PayPay gateway. PayPal Zettle card reader is perfect for occasional sellers and restaurants. It accepts all major cards and contactless payments and has a fast setup time. The card reader also integrates with third-party software such as WooCommerce, BigCommerce, and QuickBooks. You can pair Zattle with a free POS system with Bluetooth pairing, and its no monthly charge attracts occasional sellers. Monthly fee: $0 Transaction charges

Card reader cost for Android

Pros

Cons

Download the PayPal Zettle app from Google Play Store. Shopify Spotify is a well-known eCommerce platform with a free POS system for each account. Its POS system also allows a standalone payment transfer option for small retail businesses from its mobile app for selling. Different types of mobile card readers can be used with Shopify. But the feature that makes Shopify convenient is the online and in-person sales sync to your Shopify dashboard. It makes your revenue, inventory, and customer data always up-to-date. It is fully safe for you as well as for your customers. Shopify provides two card readers for Android phones and tablets: Chip and Swipe Reader for $29 and Tap and Chip Reader for $49. Monthly fee: $29 Transaction charges

Card reader cost for Android

Pros

Cons

Download the Shopify app from Google Play Store. Clover Go Clover Go is an excellent option for small retailers who want to take payment on the go. Its device is linked to with Clover Go Android mobile app. The Clover Go device is easy to use and operate, and it accepts EMV, swipe cards, and contactless payments. Retailers and customers feel confident using it because of its high payment security. The device is easy to set up and in very less time. The Clover Go credit card reader offers features based on its chosen subscription plan. In the free plan, you will get only basic features like accepting cards, viewing transactions, and sending digital receipts to customers. With Clover Go, the merchants get a full account, ensuring better account stability. Monthly fee: $0, $14.95 Transaction charges

Card reader cost for Android

Pros

Cons

Download Clover Go from Google Play Store. Loyverse As the Loyverse does not have any native card reader device, it works with other brands' devices. It works with Android-compatible credit card readers, including PayPal Zettle, PayGate, SumUp, and Worldpay. It is good to check the Loyverse credit card reader because of its zero monthly costs, including the loyalty program. Its loyalty program includes several sections such as customer relationship management, point reward system, purchase history, customer's address, loyalty cards, and notes. Pros

Cons

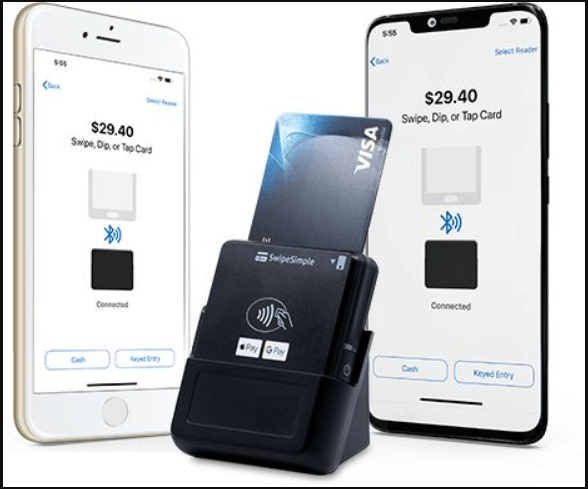

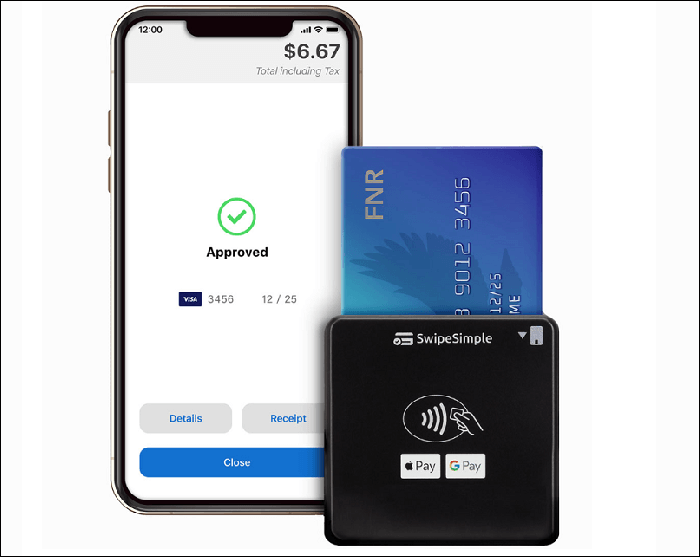

SwipeSimple SwipeSimple offers two capable Android-friendly credit card readers, and SwipeSimple B200 accepts payment from chip and magstripe cards. Another card reader is SwipeSimple B250 which receives payment from NFC, chip, and magstripe cards. It provides a full-featured mobile POS app that includes tons of solid features. Its features include an item catalog, in-app reporting, inventory management, tax settings, etc. The downside of SwipeSimple is that the company does not directly offer it; you have to purchase it through a reseller. Some of its resellers are Payment Depot, Marchant Services, and National Processing, and these resellers will determine its price. Transaction charges

Card reader cost for Android

Pros

Cons

Download SwipeSimple from Play Store. Payment Depot The Payment Depot credit card reader used the SwipeSimple Android app by CardFlight to serve in-person payments. Payment Depot comes with interchange-plus pricing instead of using a flat-rate fee. The plan of Payment Depot pricing is based on the sales volume, and it makes funding to the merchant's account the next day. Monthly fee: $15 Card reader cost for Android

Pros

Cons

Download SwipeSimple (Payment Depot) app from Play Store. Stax Stax provides the most transparent payment processing fees to the traditional merchant account. It offers subscription-based pricing in exchange for wholesale interchange-plus rates. Unlike Payment Depot, Stax provides better invoicing and recurring billing tools and offers quick deposit speeds. However, the pricing plans of Stax are based on the scaling payment features. Transaction charges

Card reader cost for Android

Pros

Cons

Download Stax Pay from Play Store. Stripe Stripe credit card reader offers a great choice for customizing reports. It includes the particularized statement of revenue, fees, refunds, and receivables. The best part is that it doesn't charge a monthly fee for its services. Monthly fee: $0 Transaction charges

Card reader cost for Android

Pros

Cons

Next TopicFax Apps for Android |