In Indian rupees, 1 Trillion is Equal to how many Crores?For those unfamiliar with it, the Indian numeral system poses a unique obstacle when converting between different currencies. In the system used in India, huge sums are expressed in terms of "crores" and "rupees." To understand the scope of financial data in India, it is crucial to comprehend the conversion between these two units. In the context of India, this article seeks to clarify the conversion between trillion and crore. We will look at the origins of the Indian numeral system, the role crores play in the country's financial system, and real-world examples of how trillion-dollar amounts are converted to crores.  Additionally, we will review the variables affecting money conversions, contrast the Indian numeral system with international currency standards, and highlight practical tools and resources for completing precise currency translations. Understanding the Indian Number SystemThe widely used Western numerical system differs from the unique Indian numerical system. Large sums are expressed in India using the phrases "crores" and "rupees." Understanding the fundamental units and their place values in the Indian numeral system is crucial to comprehending the conversion between trillion and crore. - Crore

The word 'crore' is derived from 'Koti' in Sanskrit. One crore, or 10,000,000 equals ten million in the Indian numeral system. It occupies the space represented by one and seven zeros (10,000,000). - Indian Rupee

India's national currency is the rupee. The character represents it as "₹" One rupee equals 100 paise, and the paise is a currency unit. The Reserve Bank of India (RBI) is responsible for issuing and regulating the rupee. In India, it is frequently used as a form of payment for many exchanges, including daily purchases, commercial transactions, and financial activities. The Indian rupee is denoted by the sign "₹," which was established in 2010 and is used in various financial contexts. The word "rupee" is represented by the Latin letter "R," which is combined with the Devanagari letter "ra" (RA). - Place Values

In the Indian numbering system, integers are grouped into sets of two digits according to a predetermined grouping pattern. Every set is called a "lakh," the same as 100,000. The place value of the lakh is 1, and then five zeros (100,000).

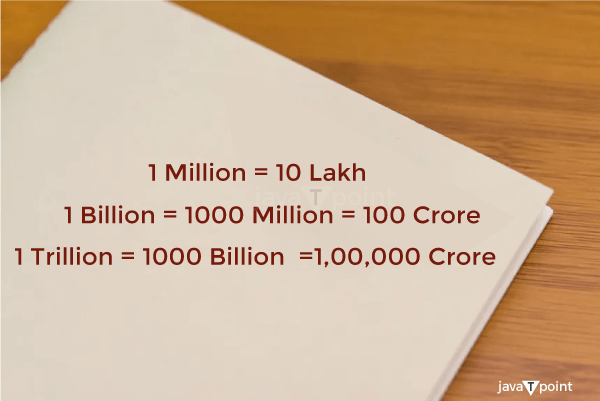

These place values are further increased to accommodate greater numbers. For instance, one trillion is equal to 100,000 crores (1,000,000,000,000), and one crore is equal to 100 lakhs (10,000,000). We may easily convert between trillion and crore by understanding the place values and grouping structure of the Indian numeral system. This enables us to better understand enormous financial amounts in India.

Indian Rupees and Crores- Indian Crore

A crore is a significant numerical value equal to ten million (10,000,000) in the Indian numeral system. It is indicated by using the word "crore" or the initials "Cr." 10 million units of the base currency, in this case, the Indian rupee, are equal to one crore. - Indian Rupee

India's national currency is the rupee (₹). It is divided into 100 paise. The Reserve Bank of India (RBI) is responsible for issuing and regulating the rupee. In India, it is frequently used as a form of payment for many exchanges, including daily purchases, commercial transactions, and financial activities. The Indian rupee is denoted by the sign "₹," which was established in 2010 and is used in various financial contexts. The word "rupee" is represented by the Latin letter "R," which is combined with the Devanagari letter "ra" (₹).

The Indian rupee's value varies from other currencies in the international foreign exchange market. Numerous variables, like economic conditions, inflation, interest rates, and market forces, impact the rupee's exchange rate. In financial computations, the Indian rupee and the Indian crore are closely related. For ease of understanding and representation when working with huge numbers, especially in conversations about Indian finance, crores are frequently used.  Trillion to Crore Conversion FactorWe must comprehend the place value link between the two units to translate from a trillion to a crore in the Indian numeral system. - One trillion is equal to 1,000 billion, or 1,000,000,000,000.

- 10 million for every crore

As a result, the trillion to crore conversion factor is: - One lakh crores equals one trillion.

In the Indian numeral system, one trillion is equivalent to 100,000 crores. This conversion ratio aids in our comprehension of the size of enormous numbers in the context of Indian finance. It is simpler to understand the value when expressed in terms of crores, a more prevalent unit used in India to indicate enormous sums. This is especially true when dealing with figures in the trillions. Example of a CalculationLet's use an illustration to show how to translate trillion into crore using the Indian numerical system. For instance, to change 2.5 trillion to crores, we will use the conversion factor of 1 trillion equal to 100,000 crores to convert 2.5 trillion to crores. - One hundred thousand crores equals one trillion.

- So, we may multiply 2.5 by 100,000 to convert 2.5 trillion to crores:

- 2.5 trillion multiplied by 100,000 crores equals 250,000 crores.

- 2.5 trillion is, therefore, equivalent to 250,000 crores in Indian currency.

By converting a huge number to crores, we can make it more understandable and relevant in Indian finance. Crores Importance in the Indian Financial ContextIn the Indian economic context, crores are quite important. They are frequently used in business, government, banking, and personal finance to symbolize significant sums of money. Here are some crucial details emphasizing the importance of crores in the Indian financial system: - The Scale of Representation

Crores are useful for portraying enormous numbers on a more manageable scale. India frequently deals with billions and trillions due to its sizable population and thriving economy. It is simpler to understand and explain these numbers in a relatable manner when using crores. - Real Estate and Infrastructure

Construction expenses, purchase prices, and investment quantities are frequently expressed in crores in the real estate and infrastructure sectors. It is typical to hear of real estate deals worth over a crore or infrastructure projects with a crore price tag. - Business and Investments

Crores are a common unit of measurement in business and investing environments for corporate sales, profitability, capital expenditures, and market valuations. It aids stakeholders in comprehending the size and financial performance of Indian firms. - Government Budgets

In government budgets, where expenses, allotments, and revenues are stated in crores, crores are basic units. The Union and state budgets provide residents and stakeholders with an overview of the government's fiscal actions by outlining the financial plans and policies cost in crores. - Media & Public Discourse

In the media and public discourse, crores are frequently used to report on financial news, examine economic indices, and discuss the financial implications of various events and happenings. It is easier for the Indian audience to understand and communicate when figures are expressed in crores.

- Personal Finance

When talking about high-net-worth individuals, investments, and retirement planning, crores are important to consider. People frequently set financial objectives in crores and use them as a barometer for financial success and wealth building.

In conclusion, crores play a crucial role in the Indian economic context, acting as a standard unit to communicate high dollar amounts in various industries. It is a crucial component of India's economic environment since it makes communicating, analysing, and comprehending financial data easier. Influencing Factors for Conversion of CurrenciesNumerous macroeconomic and market-related variables affect currency conversion rates. Understanding these elements can help explain why exchange rates fluctuate. The following are some important variables that affect currency conversion: - Interest Rates

Differences in interest rates between nations can affect the value of a currency. A nation's currency may appreciate due to increased demand due to higher interest rates luring international investors. - Rates of Inflation

The rate at which the cost of goods and services rises impacts the value of currencies. Lower inflation rates tend to result in stronger currencies since they preserve purchasing power. Higher inflation rates cause a currency's value to decline, which results in depreciation. - Economic Performance

A nation's general economic health and stability impact the value of its currency. Variables like GDP growth, employment levels, trade balances, and fiscal policies influence currency values. - Political Stability

Political stability or volatility can greatly impact currency exchange rates. Investor confidence is typically higher in nations with stable political environments, which results in stronger currencies. On the other hand, monetary changes might be brought down by political unrest, elections, or geopolitical conflicts. - Current Account Balance

Currency exchange rates are influenced by the current account balance, including the trade balance, net income from abroad, and net transfer payments. Countries with positive current account balances often have stronger currencies than those with negative balances, which can lead to currency depreciation. - Market Sentiment and Speculation

Market sentiment, investor expectations, and speculative activity all impact currency markets. Based on traders' opinions and sentiments, economic indicators, geopolitical events, and news can cause short-term changes. - Intervention by the Central Bank

The central banks are key players in managing currency values. Exchange rates can be influenced, and currency values can be stabilized or changed through central bank actions like purchasing or selling currencies, changing interest rates, or enacting monetary policies. - Market Liquidity

A currency's exchange rate may be impacted by how liquid the market is for that particular currency. Higher trade volume and market liquidity currencies tend to be more stable and draw more players, which impacts their exchange rates.

Indian Number System's Historical ContextThe history of the Indian number system is extensive and spans several centuries. Its growth and progress can be linked to several eras and influences. Here is a synopsis of the Indian number system's historical background: - Ancient Origins

The development of mathematical ideas and numerical notations can be attributed to ancient India, where the foundations of the Indian number system can be found. The Harappan culture (2600-1900 BCE), where signs like the digit "0" have been discovered, has the oldest known numerical symbol used in India. - Place Value System Invention

The invention of the place value system was one of the major achievements of ancient Indian mathematicians. Indian mathematicians, notably Aryabhata, originated the idea of positional notation during the sixth century CE. In this system, the value of a digit is determined by its location in a number. The modern Indian numerical system was founded on this method. - Brahmi Numerals Influence

The Brahmi script, a traditional Indian writing system, impacted the creation of the Indian numeral system. The symbols that made up the Brahmi numerals, which were derived from the Brahmi alphabet, stood for various numbers. In ancient India, these numerals served as the foundation for numerical notation. - Influence of Arab and Persian Numerals

Through trade and cultural exchanges, India had a great deal of touch with Arab and Persian cultures during the Middle Ages. Arab mathematicians greatly benefited from the Indian numerical system, which they used to advance and disseminate the system throughout the Arab world. The "Hindu-Arabic numerals," which finally made their way to Europe, served as the foundation for the current decimal system that is employed on a global scale. - Introduction of the Decimal System

The Gupta Empire (fourth to sixth centuries CE) saw the rise of the decimal system, which is the foundation of the Indian number system. Indian mathematicians revolutionized numerical calculations during this period by introducing the idea of a placeholder value of zero, which made complicated calculations easier to handle. - Adoption and Standardization

With the usage of particular numerals and place values, the Indian numbering system evolved into a standardized one over time. The representation of zero and other numerals underwent evolution to become their known shapes. The Indian numeral system spread quickly throughout India and its neighbours, becoming engrained in many facets of Indian math, culture, and business. It is still used in day-to-day activities, business dealings, and official documents in India.

The significance of ancient Indian mathematicians and their deep influence on the global development of mathematics and numeral notations are highlighted by the historical context of the Indian number system. Currency Comparisons WorldwideUnstable currencies have varying values, which reflect the relative strengths and economic circumstances of various countries. Comparing different currencies makes understanding exchange rates, purchasing power, and international trade easier. Here are some frequent currency comparisons across the world: - United States Dollar (USD)

The US dollar is widely used as a standard for other currencies and is the most important reserve currency in the world. It is a benchmark for currency comparisons because it is widely recognized and utilized in international trade. - Euro (EUR)

The official currency of the Eurozone, which consists of 19 member nations of the European Union, is the euro (EUR). Over 343 million individuals in the Eurozone utilize it, making it the second-largest reserve currency. - Japanese Yen (JPY)

The Japanese yen is the nation of Japan's official currency. It is a popular currency on the foreign exchange market and is regarded as a haven. - Indian Rupee (INR)

India's national currency is the Indian rupee. It is one of the most commonly traded currencies on the foreign currency market and is widely utilized throughout South Asia.

|