Market Cycles: Definition, How They Work, and TypesWhen people are talking about investing, they tend to forget a very important thing most of the time that market analysts across the globe have been saying all these years. This is something that investors keep thinking about and repeating in their sleep. It is the reason behind anyone's motivation to invest in the first place, that is:- "Over the period, the market rises". But, to understand how the ups and downs work in the market, we first need to get a hold of the term market cycles. What Are Market Cycles?Market cycles which also go by the term 'stick market cycles', is a broad term that refers to all the patterns that emerge during various markets or business environments. When a cycle is going on, some of the asset classes or securities perform better than others as they have their business models aligned with conditions that lead to growth. The time frame of a market cycle differs from one person to another depending upon the trends or patterns that they seek.  Market cycles refer to the period between the two most recent highs or lows of a common benchmark. For example, S&P 500 highlights the performance of a fund with the help of both an up and a down market. A market cycle generally has four different phases, and it gets nearly impossible to identify what phase a person or company is in at a particular point in time. Different securities have different ways of responding to market forces at different times in a full market cycle. How Market Cycles Work- A new market cycle is formed when trends or patterns develop within a particular industry or sector in response to new innovative ideas, products, or regulatory environment. Such trends are often known as secular.

- At the time of these cycles, revenue and net profits both show similarity in growth patterns among a lot of companies with the same industry, which is cyclic in nature.

- A strange thing with market cycles that can be very well regarded as a problem is that they are difficult to point out until the end of it, and it is even difficult to decipher the starting and end point of a market cycle. This affects the formation of policies and strategies and leads to confusion and controversy during these assessments.

- However, it is believed to exist by most market veterans, and not only market veterans but many investors also pursue those investment strategies that aim to lead to profit by trading securities before the shift in the market cycle.

- There are stock market oddities that have no known cause but continue to happen every year.

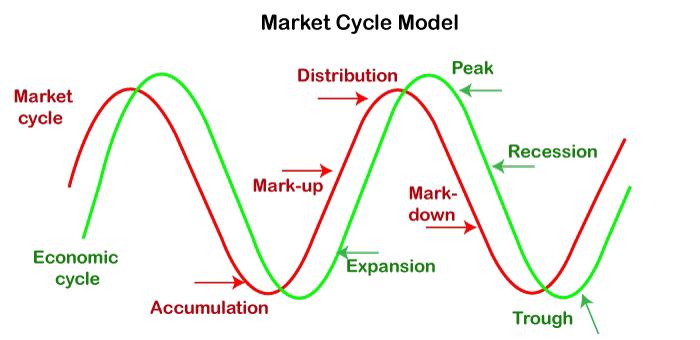

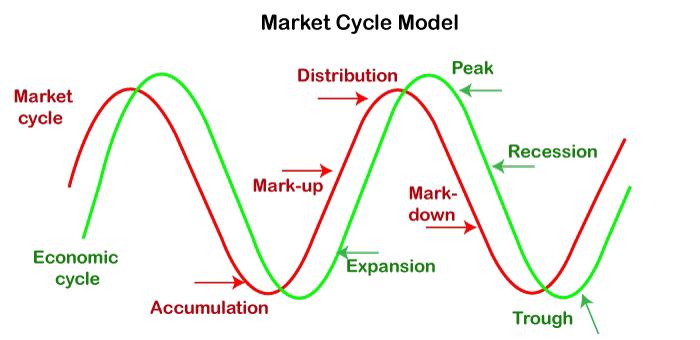

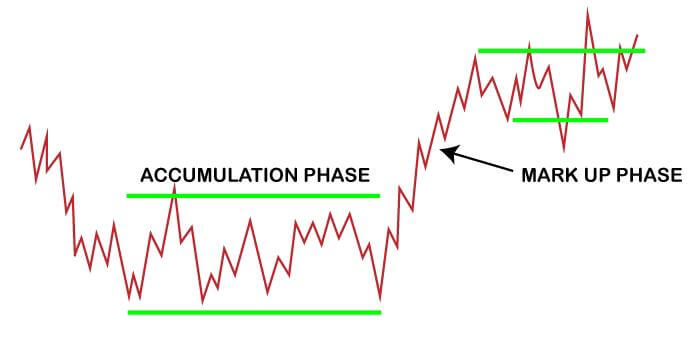

Particular ConsiderationsAs there are multiple markets to consider, a market cycle can last anywhere from a few minutes to several years, depending on the market in question and the time horizon being considered. Different professions will examine various facets of the range. A real estate investor will look at cycles lasting up to 20 years, as opposed to a day trader who may focus on five-minute bars. Understanding The Ups And Downs Of The Market CyclesThere is no doubt in the fact that when the market tumbles and falls 15 to 20 percent due to a certain global situation like that of COVID -19, it becomes tough for the peopl3 in the market, such as investors, suppliers, shareholders, and even consumers, to have a positive outlook on the market. It becomes tougher to believe that the market will go up as we look at the time it took for it to fall.  Still, to the people who work in the market, be it of any kind, there is always good news, and that is the fact that there were many periods of uncertainty before in the market, but despite everything that happened earlier in the history of the market, sooner or later the market went up. This upward trend after an extended downfall gives investors a great opportunity to invest in the market when it's low. Types of Market CyclesThere are four types of market cycles present. Market cycles are believed to show four phases. As mentioned earlier, various securities respond to market forces differently during different stages of a complete market cycle. Let us understand this with the help of an example - During the time of a market upswing, all the luxury goods and products out there perform well as the consumers are comfortable buying expensive things such as Harley Davidson motorcycles and powerboats. In contrast, when the market is going down, the industry that deals with consumer durables perform well as people do not cut back their consumption of daily use goods such as toothpaste and toilet paper during a market pullback. The Four Stages Of A Market CycleThere is an investing reality that should not be but is always forgotten by the people of the market, and that is the market fluctuations, also called "volatility". The market can be volatile during every phase of a market cycle. We only notice it when the market goes down, and the reason might be that losing money leads to a far more emotional outburst than seeing ourselves gaining profit, even though we only expect our investments to do a profit over some time. It Is no doubt that market fluctuations are unsettling for the people of the market, but we should also consider the fact that they are inevitable and are bound to occur. Also, it is no one's power to predict an upcoming fluctuation in the market. Developing an understanding of how the market cycle works can help us gain a better perspective of the market situation and be ready during times of uncertainty so that we can focus on our investment plans and continue to achieve personal goals. The four stages of a market cycle are: 1. Accumulation-- At this point, investors start purchasing again because they believe that the worst is in the past, the markets have "bottomed out," and the outlook for the economy is favorable. This means that the value of the products is high, and at the same time, the price is low.

- The innovators (business insiders and a few value investors) and early adopters (clever money managers and experienced traders) start to buy during this period after the market has bottomed out, believing that the worst is gone. The market is still in a gloomy period, and the values are very good.

- People who held onto their investments during the worst of the bear market have recently given up and sold the rest of their holdings in disgust as a result of articles in the media that only indicate doom and gloom.

- Prices have leveled off during the accumulation period, though, and for every seller who throws thrown the towel, someone is ready to buy it at a good discount. The mood of the market as a whole starts to change from negative to neutral.

2. Mark-up Phase-- This phase is known to be the second wave of buying, as this is the time when the market is more stable. Compared to other stages, this stage is rather easier to identify with all the news outlets highlighting the up rise of the market and investors making their comebacks to the market.

- This is the stage where the market has started to move in an upward trend after staying stable for a certain period of time. Early adopters are joining the bandwagon. This category includes technicians who identify the market's direction and attitude that has changed after observing higher lows and higher highs.

- Stories can be heard in the media that the worst of the market is past us, but the situation gets worse in the case of unemployment, and the reports of layoffs increase in many sectors. As this phase continues, a large number of investors jump in with their money as greed and fear of missing out topples the fear of being in the market and the risk that comes with it.

- During the end time of this phase, the majority of people who were late to him into the market came forth and started investing, increasing the market volumes substantially. It is at this time that the theory of the greater fool becomes true. Valuations rise beyond the level of historical norms, and logic and reason aren't much in use in this phase. On one side, the late majority is jumping into the market, and on the other hand, smart money and insiders are unloading.

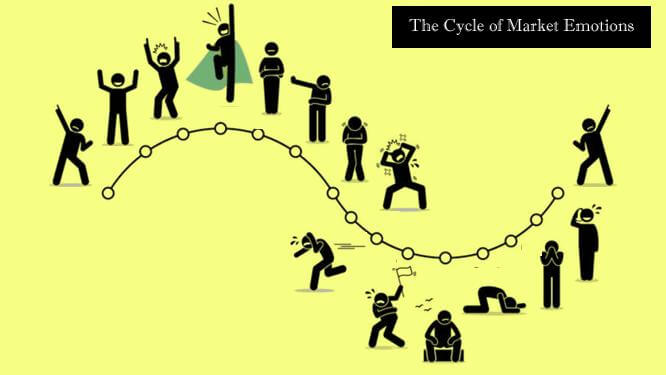

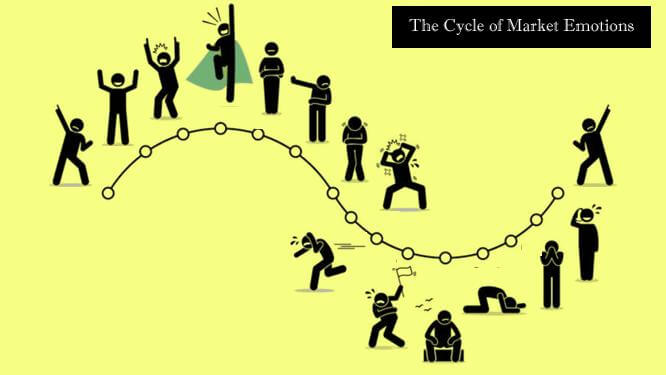

- But as soon as the prices start to come at a certain level or the rise of the prices slows down, the slow horses of the market who have been staying on the periphery for a long time see this as an opportunity and come forth to invest. There is a last parabolic movement of the prices, which is known as the selling climax in technical analysis, as this is the time when the largest gains happen in the shortest period. But this phase is an emotional rollercoaster phase of the market cycle as the emotions of the people go from neutral to angry to downright delightful during this phase.

3. Distribution-- The peak in product pricing is now occurring at this stage of the market cycle. The "Bull market" that had been robbing prices earlier started to level out gradually, and the market is now seeing an equal number of buying and selling.

- The sellers start to take control of the market during this stage. The market's positive feelings from the previous stage are believed to change into rather mixed sentiments during this phase. The prices are locked in the trading range very often, and the situation remains the same for weeks or even months.

- But the thing about this phase is that it can come and go briskly. For several companies, the distribution phase was not even a month long, but for some, it may be several months.

- As soon as the distribution phase comes to an end, the market reverses its direction. There are several classic patterns like head and shoulders patterns, and double and triple tops are some examples of the movement of the market after the distribution phase.

- The distribution phase is an emotionally exhausting phase for the markets, as the investors are surrounded by different kinds of feelings, such as complete fear but some hope for the good, accompanied by greed as it often looks like the market is taking off, but it rarely is. Valuations are too much most of the time, and the value investors have been resting on the sidelines for a long period. Most of the time, sentiments of the market start to change, although slowly but surely. This transition, however, can pick speed with the occurrence of a negative geopolitical event or extremely bad news about the economy.

- Those people in the market who are unable to trade in a profitable manner settle for a break-even prize or suffer a small loss.

4. Downtrend-- This phase is sometimes known as the "markdown" phase and is the final stage of a market cycle. This stage involves widespread selling of assets as the investors across are trying their best to gain as much profit as they can and avoid major financial losses.

- This phase is the fourth and final phase and is extremely painful for the people who still hold positions in the market. Many people hold on because their investment has lost more than they paid for it, acting like a pirate who jumps overboard while holding a bar of gold and won't let go in the hopeless belief that they would be saved.

- The latecomers, many of whom purchased assets during the distribution or early markdown phase, only give up or capitulate after the market has gone down by 50% or more.

- It is unfortunate that this markdown phase is a buy signal for the early innovators and an indication that a bottom is at hand. Now, sadly the new investors would buy the reduced investment at the time of the new accumulation phase and earn profit from the next markup phase.

The Difference Between Bulls And BearsThese terms are used to describe the shifts that take place in the trends in the market across the globe; different people have their definition of what marks the beginning and the end of each trend, which is often an upward or downward movement of 20 percent or more in the stock price. But in actuality, it refers to any extended period of market action in either the bull (up) or bear (down) direction. The Best Way Forward- There are a lot of factors that directly influence the market. Some are easy to predict coming, while some factors are invisible to us.

- In uncertain times, getting past generally isn't just about knowing the actual phase of a market cycle we are in.

- Typically is very hard for us to identify the stage we are in, and it is only when we look back we differentiate the beginning and end of each stage of the market cycle.

- The benefit results from having a working knowledge of market cycles. The next step is recognizing (and trusting) that the best protection against inevitable market downturns is establishing an investment strategy tailored to your unique goals and objectives and following it.

|