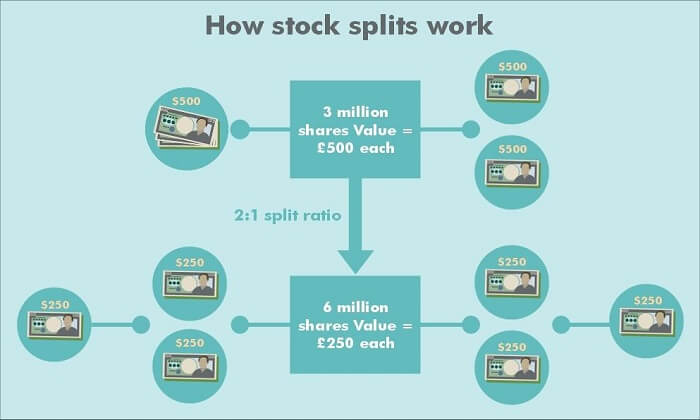

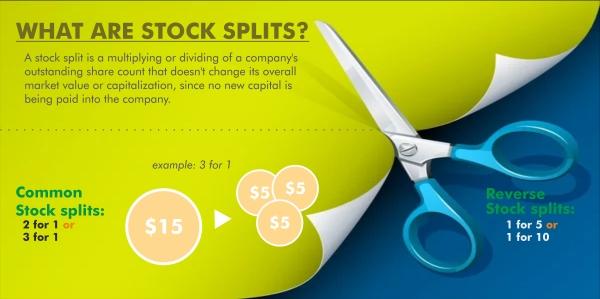

What a Stock Split Is and How It Works, With an ExampleWhat is a Stock Split?In the simplest form, a stock is an equity, and it is also the security of the investments for the ownership in a fraction of the authority which is providing the stocks. The shares are the units in which inventories are counted. The stakes only make the person an owner of the authority's part in the assets and profits, equaling the number of stocks they own.  It is said that a stock split is done when the stock's issuing company increases the number of shares to enhance the liquidity of its stocks. But, the rise in the number of shares is made sure to be done by a specific multiple. Hence, the total value of the dollar is the same as the split does not fundamentally change the value of the company. The most general division observed happens in the ratio of 2 for 1 (2:1) or 3 for 1 (3:1). It typically depicts that for every single share owned before the split, the holder will have two or three shares more, respectively, post the split takes place. How does a Stock Split work?A stock split is nothing but just an action taken by a company for the corporate interest. By stock split, a company issues additional shares to the stockholders, improving the total specified ratios, which were owned by them previously. Very often, the company decides to take such a decision to increase the shared liquidity in trading price to a more approachable and comfortable range for the most investor by reducing its trading price. Many small investors are comfortable buying shares with low trading prices, say, 100 shares of a $10 stock instead of 1 share of a $1,000 stock. Hence, when such a rise in price has taken place considerably, many of the companies declare such stock split to reduce it. In spite of the increase in the number of shares taking place in the remaining share, the value of a stock is the same as the pre-split amount. However, the company does not suffer any loss or gain from the stock split approach. It is the decision taken by the Board of Directors of the company regarding finalizing the ratio by which the split should be done. For example, 2:1, 3:1, 5:1, 10:1, 100:1, and others. Thus, in simple words, for a split of 3:1 ratio, an investor will own three shares instead of one. Hence, the number of shares will increase. Likewise, the price will be divided by 3:1 stock by dividing the older share price by three. As already stated, this is not done to change the profit or loss of the company; this is because the value of a company, as measured in market capitalization, remains the same, irrespective of the stock split.  Can a Stock Split be done in any other ratio other than 2-for-1 or 2:1?The 2:1 stock splitting ratio is very commonly used everywhere. This ratio is used unless the company's board of directors has another opinion, and sometimes they ask other shareholders as well. As a result, the split ratio can be 3:1, 10:1, 3:2, etc. Any other ratio can also be used if the company approves it. An Example of a Stock SplitIt was in August 2020 when Apple (AAPL) utilized a stock split approach with a ratio of 4:1. In that case, each share had cost about $540 before the stock split. However, after the stock split, the cost per share was opened for the market at $135, which can be calculated as $540 ÷ 4 (4:1). In that case, any stock investor who owned 1000 shares prior to the split later owned 4000 shares after the split. The outstanding shares of the Apple company, as a result of the split, increased by 10.2 billion, from 3.4 billion to approximately 13.6 billion. In contrast, the market capitalization stayed constant at $2 trillion. It entirely depends upon the company the number of times it wants to split the stocks. For example, Apple also split its stock in the ratio of 7:1 in the year 2014 and 2:1 in 1987, 2000 and 2005. Does the value of the company reduce post the Stock Split?After the stock split, as already told that the fundamental value of the stocks never gets changed, but the number of outstanding shares rises. Despite all this, the company's all-over value does not fluctuate. Just after the split is done, the price of the share will get settled downward to show the proportionate market capitalization of the company. If the pay of the company is the dividend, then the dividend per share needs to be altered considering the changes and maintaining all over dividend payments similarly. Furthermore, since the splits are non-dilutive, meaning that some vote rights will still be held by the shareholders that they previously had.  What are the advantages of a Stock Split?Things are done to gain benefits in some form or the other. Why would companies need to create some trouble and split stock? In particular, the company makes the decision to split stock only when the cost of the stock is too high. This makes it very costly for investors to get a standard lot of 100 shares. Secondly, the more shares in number, the greater the liquidity of the stocks as a result. This serves as an increase in trading and may reduce the bid asked. The trade-in stocks get more accessible for the purchaser and seller when the liquidity of the stock is increased. The company can also henceforth again buy the shares at a lower amount as liquid security will be carrying a lesser effect on its orders. According to the theory, the stock's price should have no effect post a split. This, many times, however, results in renewed investor interest, which may affect the stock price positively. However, this may also fade away with time. The split stocks from blue-chip companies are the display of a bullish signal for investors. Hence, a stock split may be seen as the desire of a company to have a substantial prospect of growth. For this, the stock split showcases a company's executive-level confidence. Walmart, a company, for example, has done stock split at the ratio of 2:1 around 11 times over time. This happened just in the period between October 1970, when retailers made their stock market debut, and March 1999. In Walmart's initial public offering, a person brought 100 shares and saw the stakes grow to about 204800 shares over the next 30 years without making any additional purchases. Many top companies often oversee their share price returns at varying levels from when the stock was first split and then approach another split accordingly. What are the disadvantages of a Stock Split?A company does not always benefit from the stock split. This process of a stock split is not as easy as it seems to be, and it requires finance and legal oversight and is to be performed by obeying moral laws. No over-market capitalization value should exist as if a company wishes to split stock. It cannot be said that a stock split is worthless, but it does not have a full effect on the fundamental position of a given company. Hence, do not formulate any additional value unnecessarily. Some people simulate the stock split as cutting a piece of cake. But, it needs to be understood that if the dessert is not delicious, no matter how many pieces it is cut into. Some consider a stock split to be a competitive strategy and view the act as having the potential to draw near crowds of less knowledgeable investors. For example, Berkshire Hathaway's Class A shares were sold for hundreds of thousands of dollars. If Warren Buffet had done a stock split, there would have been many people in public who could afford those shares of his company. Apart from this, it is said that some companies purposely reduce the company share price. Public sharing, such as NASDAQ (National Association of Securities Dealers Automated Quotations), needs stocks to trade at $1 or more than that. If the cost of the share goes below $1, then a compliance warning will be given to the respective company for thirty days continuously, and a deadline of 180 days will be given to reestablish compliance. If the price of the company's stock still does not reach the minimum requirement, then there is a risk of being delisted. Is a stock split profitable or harmful?As we have read, the stock split is performed at a time when the price of the company's stock has increased so much that it gets difficult for new investors to look into it. Hence, a split is mostly understood as the harbinger of growth and as a positive symbol. Furthermore, the amount of stock which has just been split may be seen as an uptick if new investors are getting attracted at the lower nominal share price. What is a Reverse Stock Split?A reverse stock split is nothing but the reverse mechanism as compared to Stock Split. It is completely opposite to the stock split. Here, the number of present shares is decreased instead of increased as in the stock split, making the shares more valued proportionally. Differences: Stock Splits vs Reverse Stock SplitsA reverse stock split, also known as the forward stock split, is just the complete opposite of a conventional stock split. A company which takes in the reverse stock split decrease the number of its shares which are outstanding and hence the price of the share rises in the equivalent ratio. Like a traditional stock split, the market value of the company remains the same after a reverse stock split.  Because there are certain price requirements to remain listed, a company may also be obliged to undergo such a corporate action (reverse stock split). If the share price declines to such an extent that it would be delisted from the exchange, it is better to utilize the reverse stock split technique. Some of the mutual funds may also not fulfil the minimum required amount for being on the list. Simply put, if any stock is costed below a preset minimum per share, then there are some relative mutual funds in the market which might not invest in such stocks. In order to make its stock more attractive to investors, who may wish to give more amounts for more valued products, a company may take a decision to go for a reverse split. A reverse stock split or a forward split is a special stock split strategy. The companies use this technique to reduce the stockholders holding less than a given number of shares. With this approach, the whole number of shares owned by a stockholder is reduced. This leads to cash out of some of the shareholders who own less than the minimum, which is the necessity of the stock. What would happen if the share I owned underwent a stock split?You personally need not do anything. All the things would be simultaneously done by your broker. For example, in any 2:1 stock split, before the split, suppose a person held 100 shares, which were being traded at $50 earlier. Now, after the split, that person would possess 200 shares at $25 each. Here, the owner of the share automatically gets credited with the additional amount of share with deducted prices in a proportionate manner after a stock split. What are outstanding shares?Outstanding shares refer to the stocks which are owned at the present moment by the shareholders of any given company. Restricted shares and share blocks are also included in this. What is market capitalization?Market Capitalization depicts the present value of entire outstanding shares of the specific company. This amount is, in general, shown in the dollar. What does split adjusted mean?Split adjusted can be defined as the change brought in the data of the stock by modifying the value of the shares by permitting the comparisons to the previous information. What is a share turnover?A share turnover is a way to count the liquidity. It is calculated by dividing the shares traded in a certain period by the average outstanding shares. Some Essential Key Takeaways

|