Debit Note Format in Excel

Introduction

In Microsoft Excel, a debit note is a formal documentation of modifications made to financial transactions; it especially shows deductions from accounts payable. Buyers must use this document to notify sellers of debits, which are frequently the result of inconsistencies like defective merchandise or incorrect pricing. A organised style with headers for the date, vendor information, and an itemised table for goods or services are common components of the Excel format. Using formulae to do computations automatically improves productivity. Debit notes facilitate unambiguous communication between participants in business transactions and guarantee accurate and transparent financial records. Excel's adaptability and ease of creation make it a top choice for handling debit note transactions.

What do you understand by the term "Debit Note format in excel"?

The phrase "debit note format in Excel" describes a planned arrangement created in Microsoft Excel to record and convey monetary modifications made during commercial dealings. Debit notes are official correspondence between a buyer and a seller that indicate amounts deducted from accounts payable for a variety of reasons, such as defective merchandise, mismatched prices, or inaccurate quantity. Important elements including the date, vendor data, item details, total debit amounts, and further remarks are usually included in the Excel format. It is a methodical approach that encourages correctness and openness in financial records by listing and explaining the reasons for debits. Users may use the spreadsheet's data organisation and calculation features to tailor the Excel template to meet unique business requirements. Excel's debit note format is a vital resource for upholding honest financial statements and transparent communication in business dealings.

Step by Step procedure

Follow the below steps:

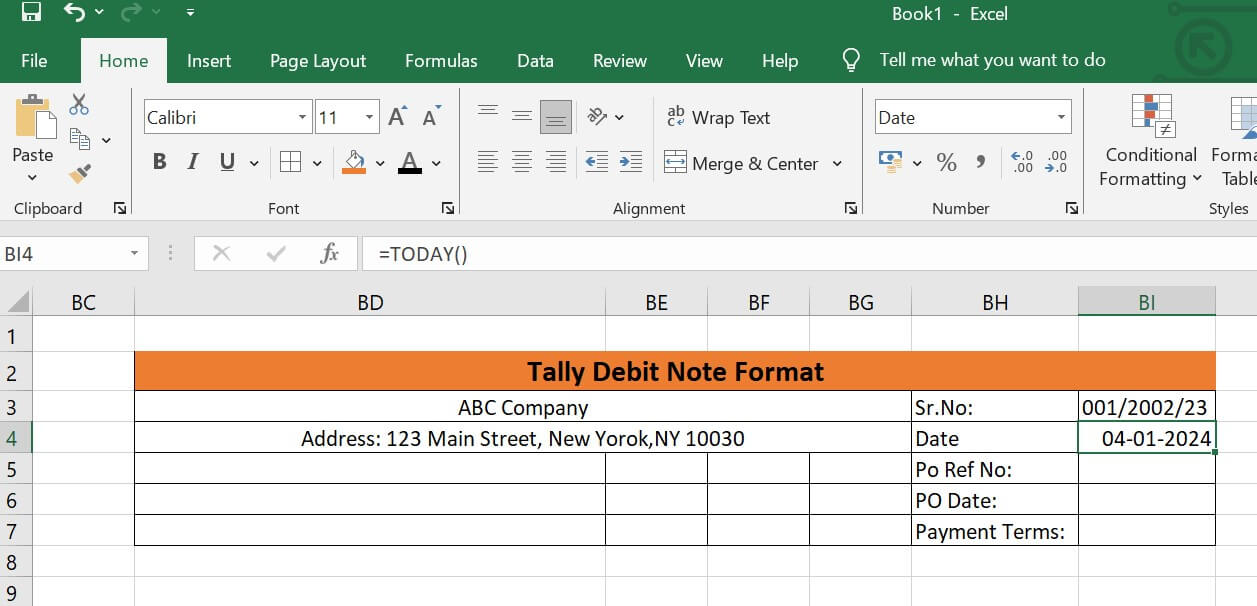

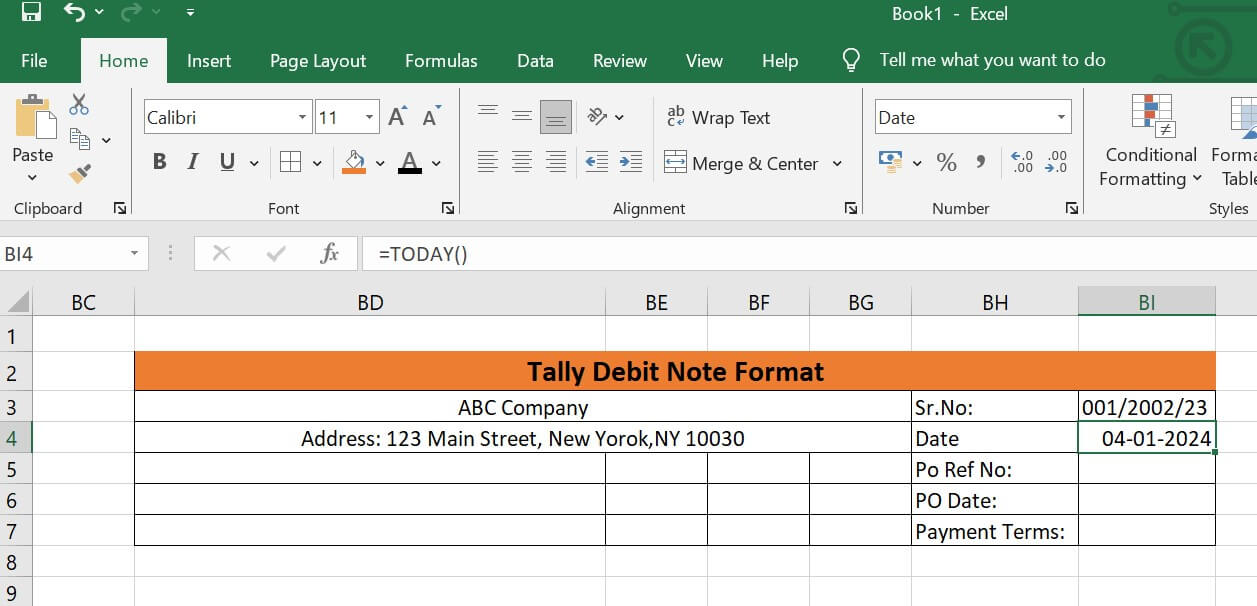

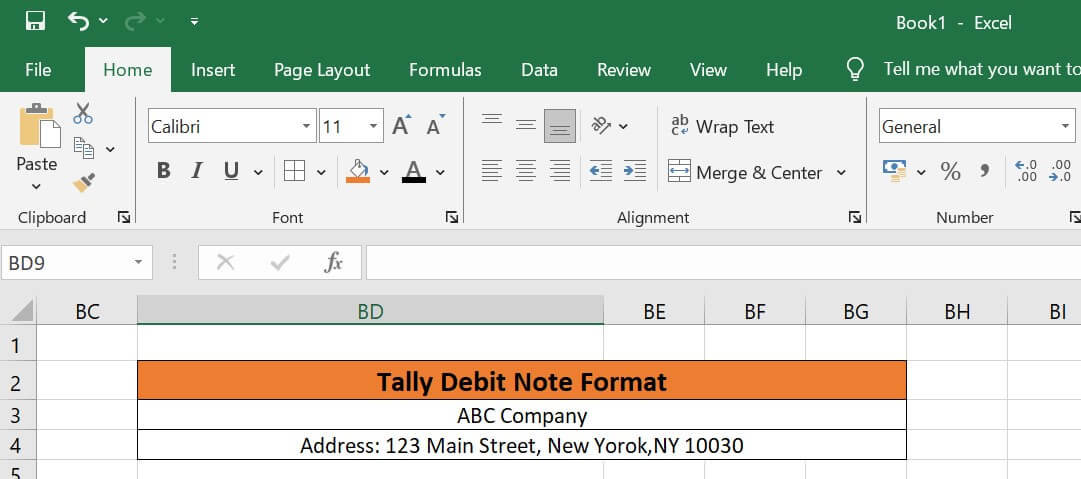

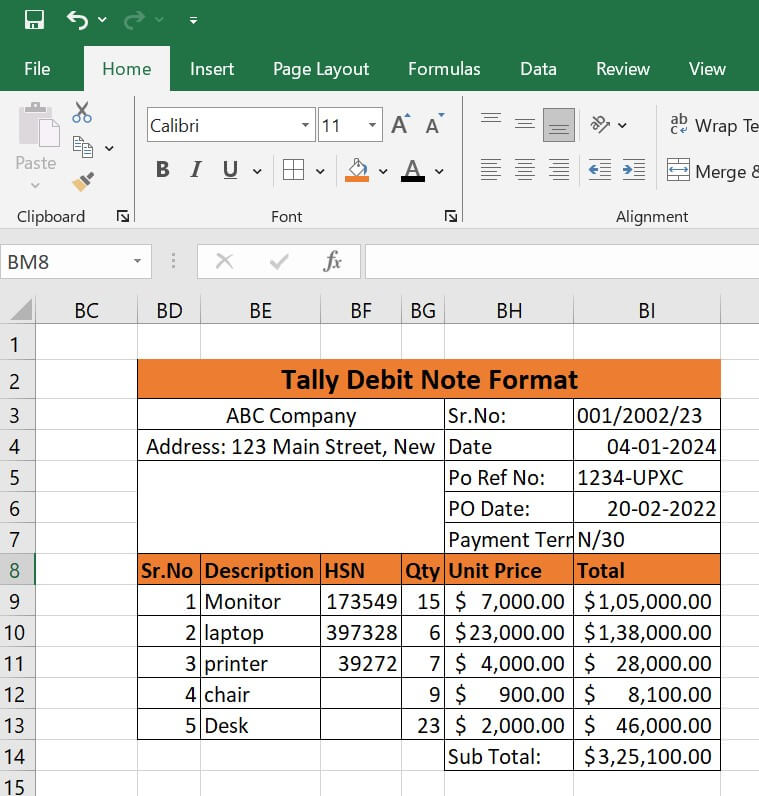

Step 1: Enter Address & Company Name

- Initially we will enter some data to create a debit note format.

- First, put the firm name here.

- Next is their address, which provides the location of the company. The location serves as a symbol of the company's direction. Thus, it is easy for someone to locate the location if they choose to visit.

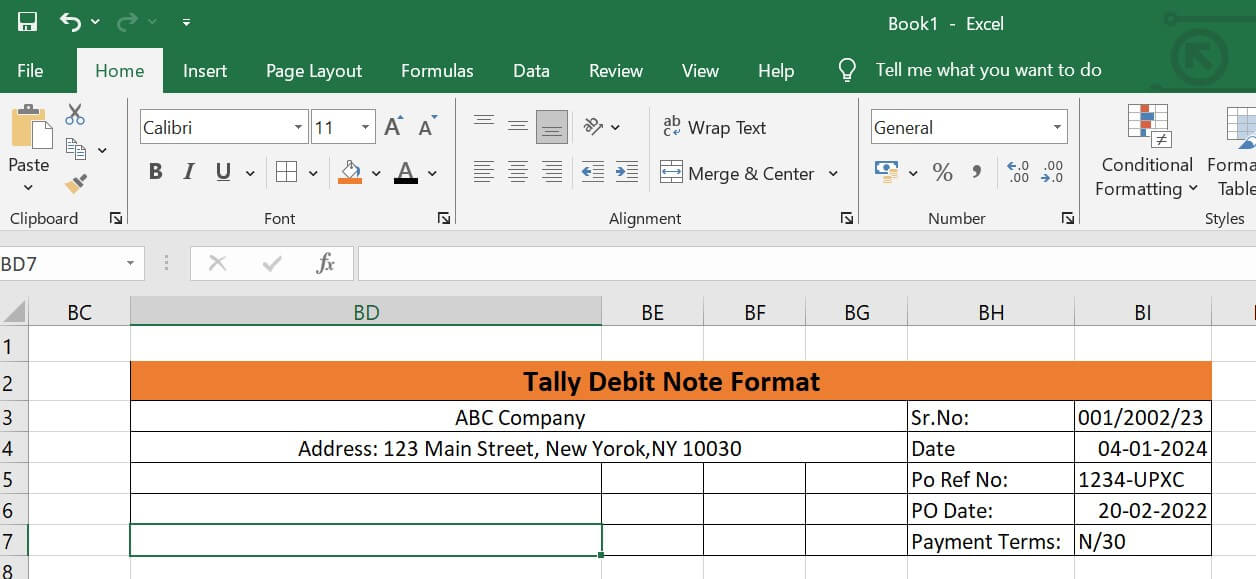

Step 2: Configure Order Specifics

- We now have to set the order total details.

- To begin with, we simply enter the serial number in column H4 and designate it as Sr. No.

- Next, enter the current date in column H5. We utilise the TODAY function for the date since we are creating an updated debit note format.

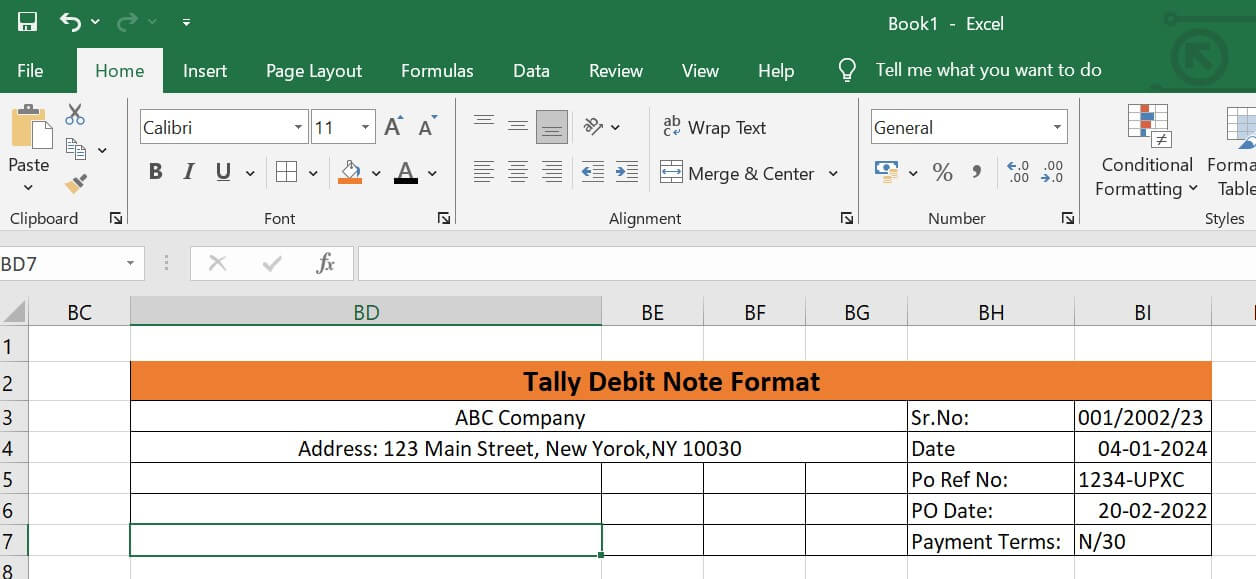

- Thirdly, provide the purchase order number reference in column H6.

- The purchase order number reference, or Po Ref. No. An order number is a unique identification code assigned to a purchase order that both identifies the nature of the transaction and acts as a formal statement of the customer's intention to make a purchase from a vendor.

- Next, just enter the date of the purchase order in column H7.

- We just set the payment arrangements after that. Documentation defining the terms and conditions under which customers will pay for goods and services is known as the payment term.

- The conditions of payment in this instance are N/30.

- Here, N stands for the net amount that must be paid in full. When an invoice states "Net 30," it means that payment is expected thirty days after the invoice date. It says that following the invoice, the consumer has thirty calendar days to pay.

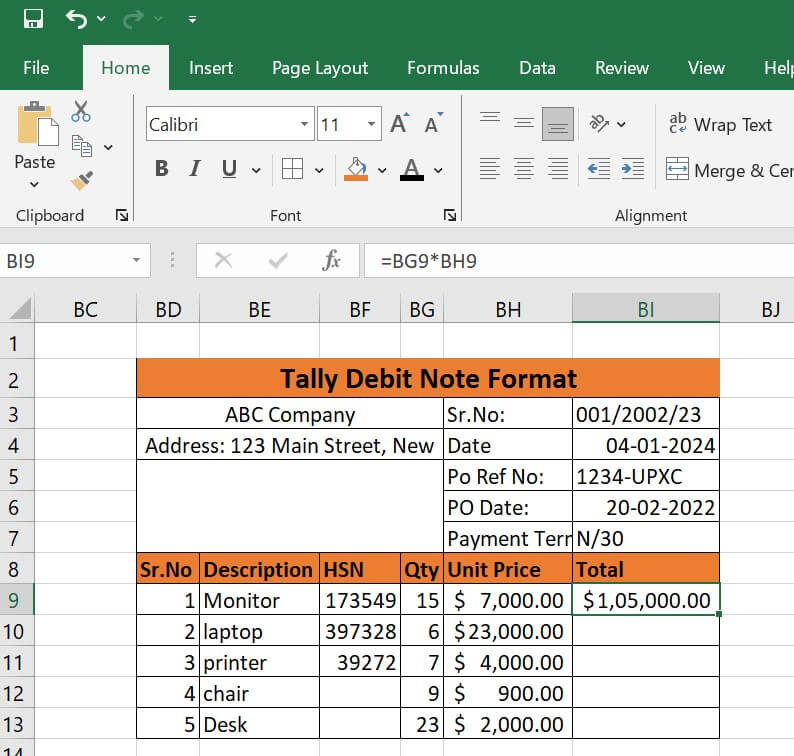

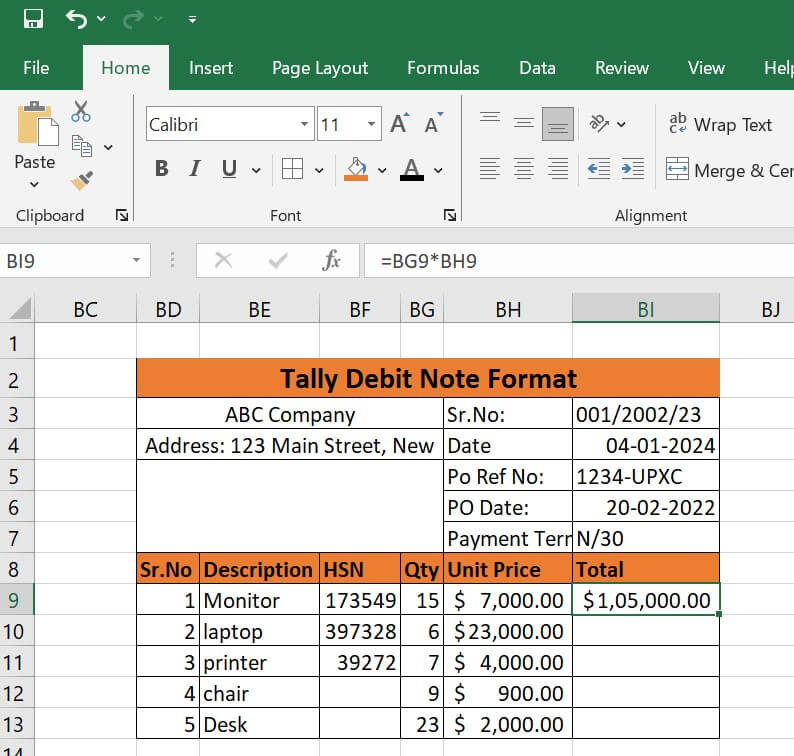

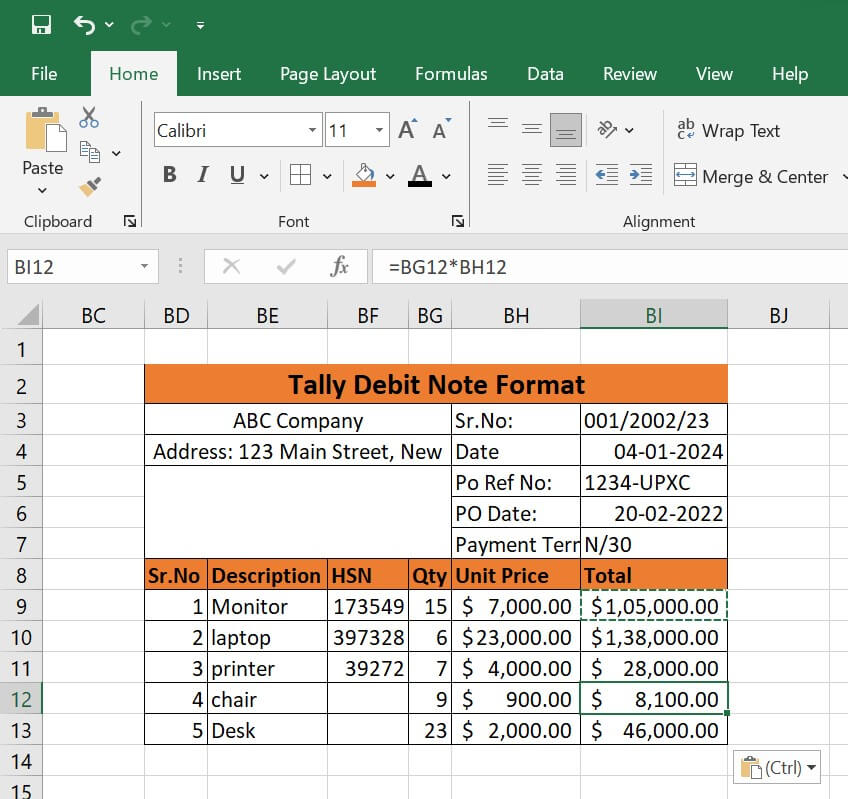

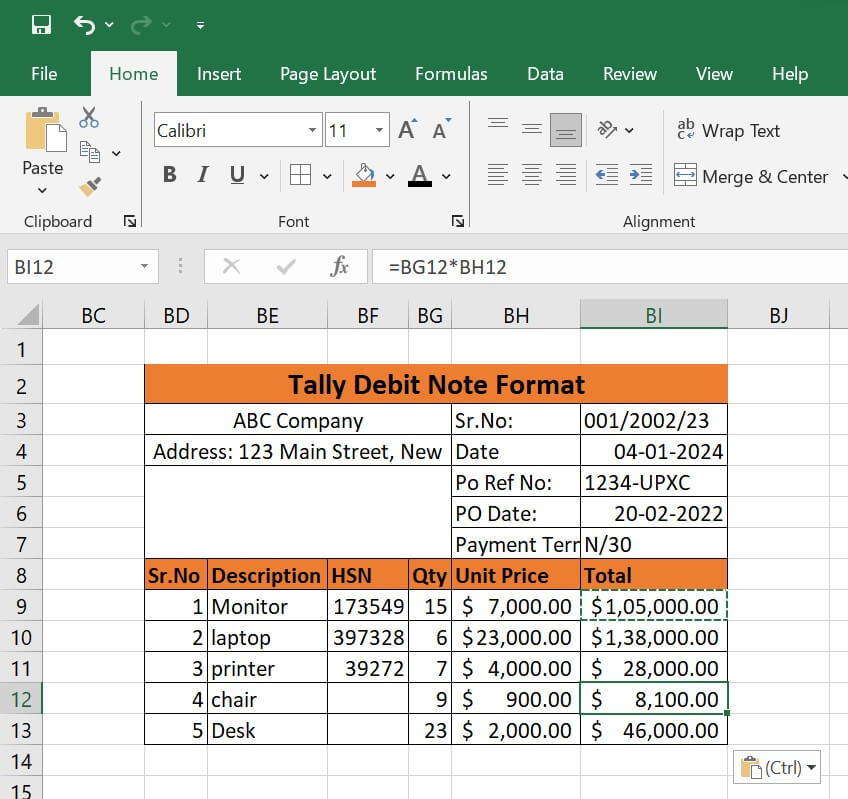

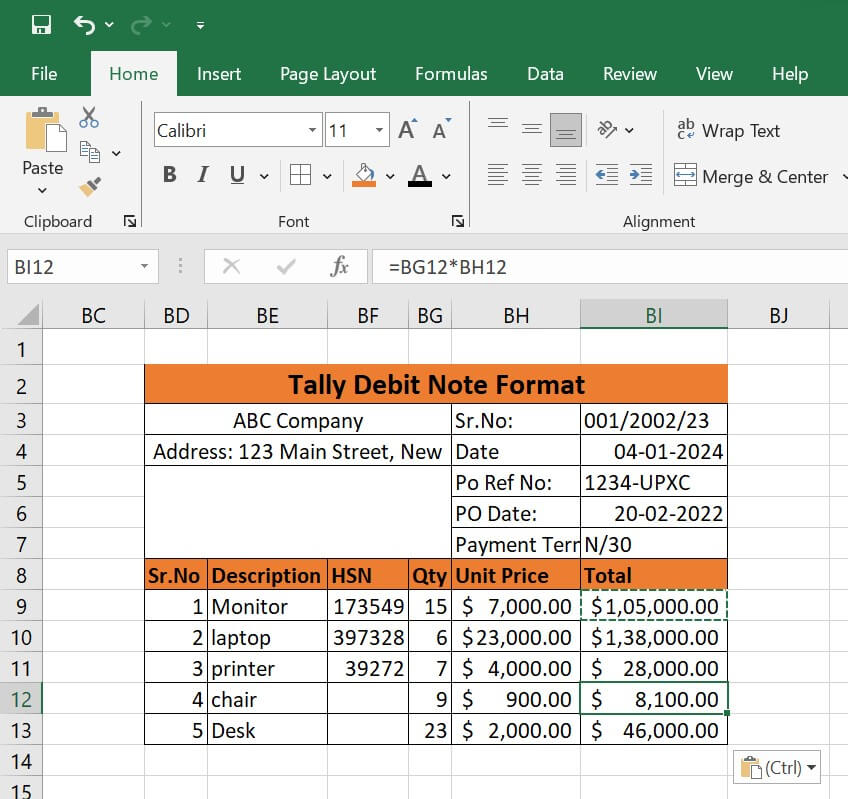

Step 3: Characteristics of Input

- We will now enter every feature needed to create the debit note.

- First, we put the serial number together. We utilise the IF function in conjunction with the COUNTA function to get the serial number. The serial number will be assigned automatically if the description contains any information.

- Therefore, enter the formula in cell B10.

- Using the keyboard, press the Enter key.

- Following that, the formula will show up in the formula bar and you will be able to view the result in the selected cell.

- Additionally, pull the Fill Handle down to duplicate the formula over the range. Alternatively, to AutoFill the range, double click the addition (+) symbol.

- Set each piece of information one at a time now. the explanation provided for each product. The Harmonised System of Nomenclature, or HSN, is a system used to classify items.

- Additionally, we enter the quantity, or Qty as it is short for quantity, which denotes the number or amount of anything.

- Lastly, the cost of a solitary good or service. primarily the cost per unit for every product.

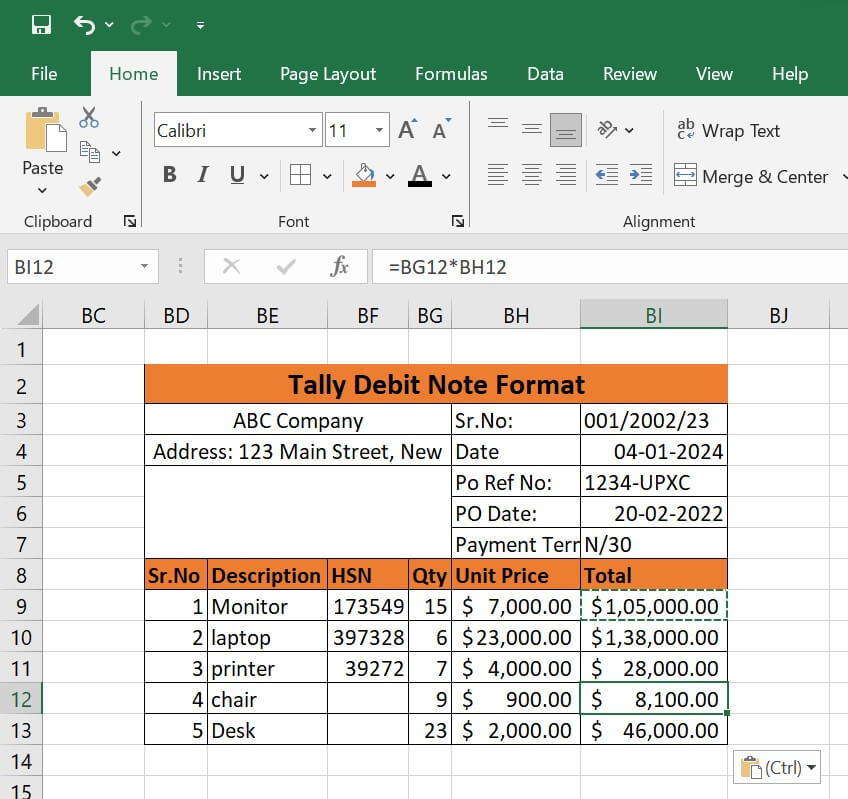

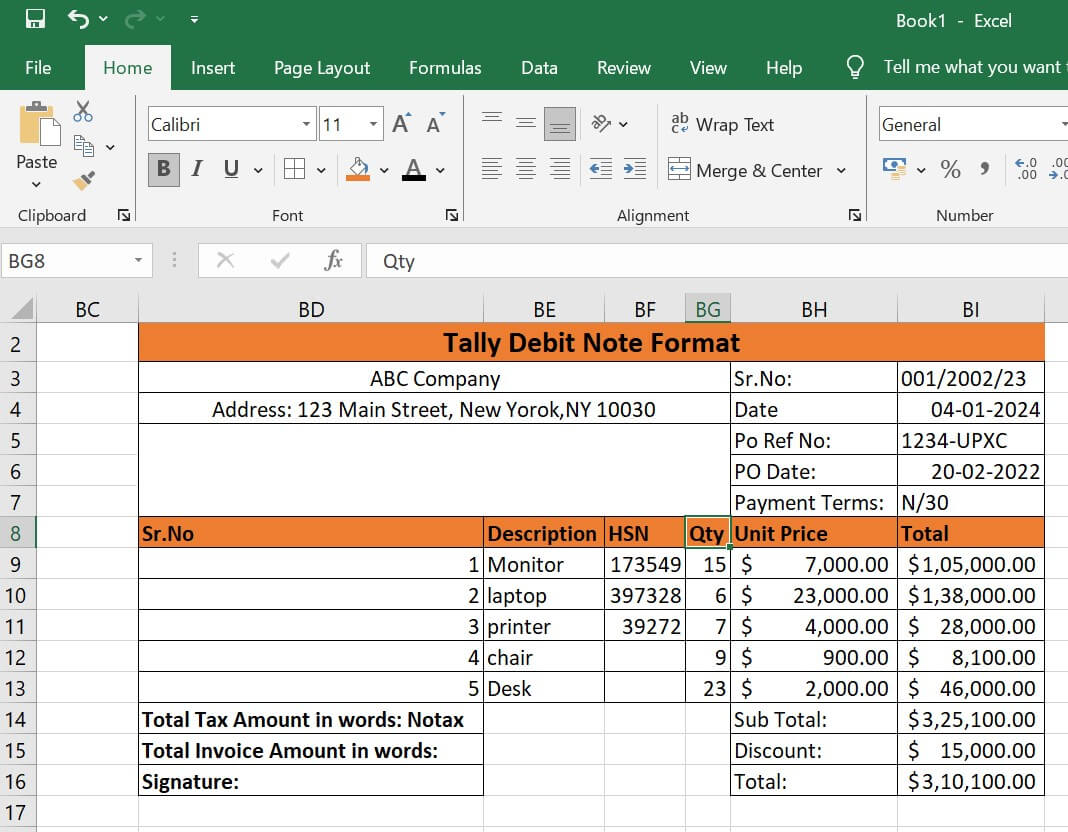

Step 4: Determine the Total Debt

- This phase involves figuring out the total cost of each service separately as well as the subtotal of the entire service, including the discount.

- First, choose cell H4, and then multiply the amount by the unit price to find the total cost of each service. Just apply the formula.

- Second, hit Enter to view the outcome in the chosen cell.

- This will allow you to see both the formula in the formula bar and the data in the selected cell.

- To copy the formula across the range, pull the Fill Handle down now. Alternatively, double-click the addition (+) sign to AutoFill the range.

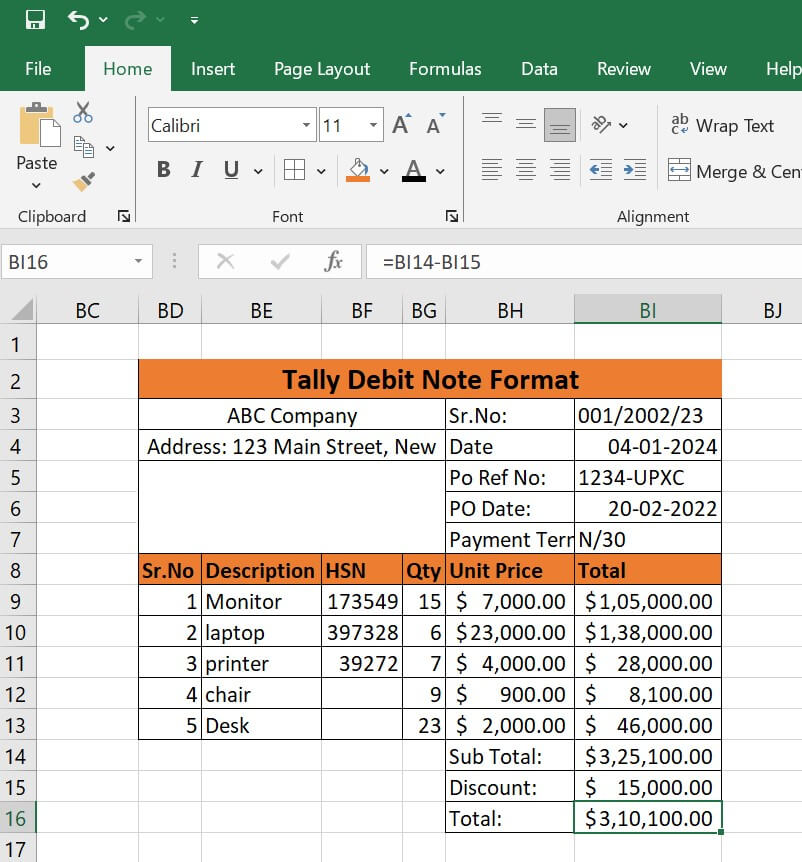

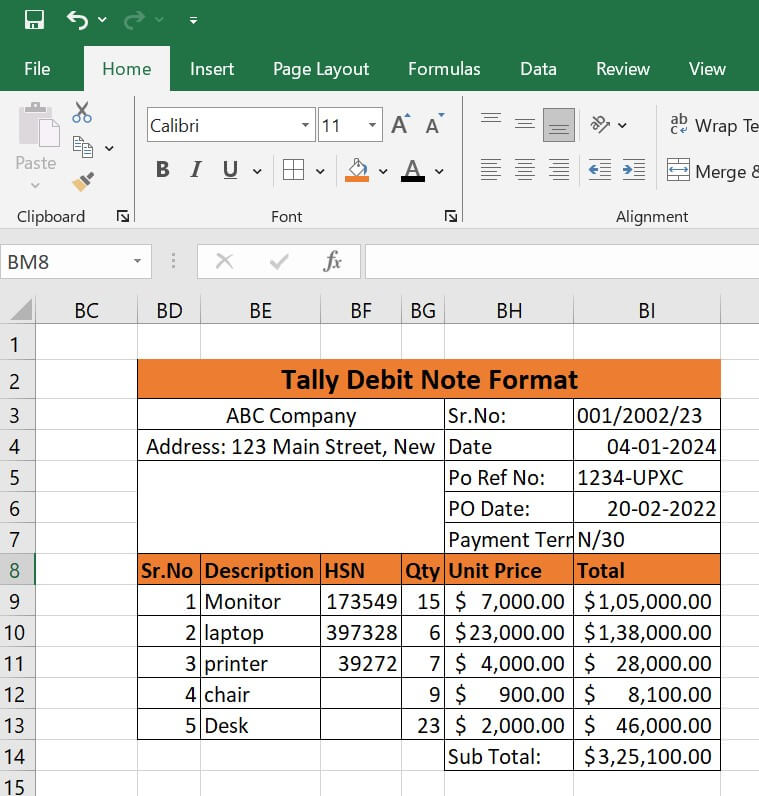

STEP 5: Use SUM function

- We use the SUM function to calculate the subtotal. Select the cell and input the formula into it.

- Using the keyboard, hit the Enter key.

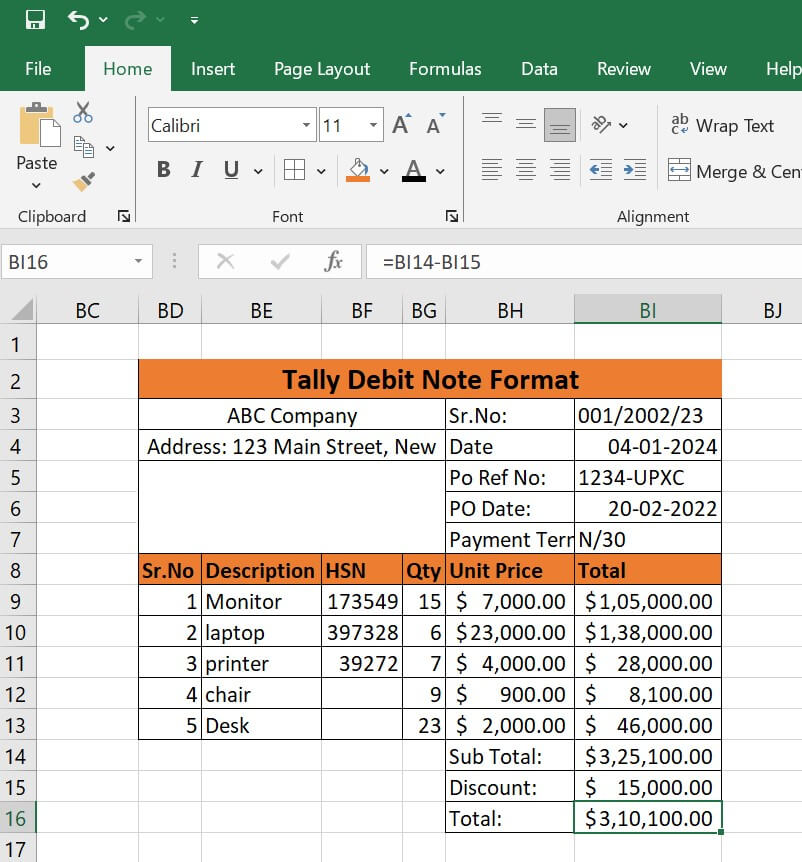

STEP 6: Enter Hit

- We also receive a $15,000.00 discount.

- Moreover, we only deduct the discount from the subtotal to get the total. Thus, enter the subtraction formula in the chosen cell.

- Lastly, to complete the process, hit the Enter key.

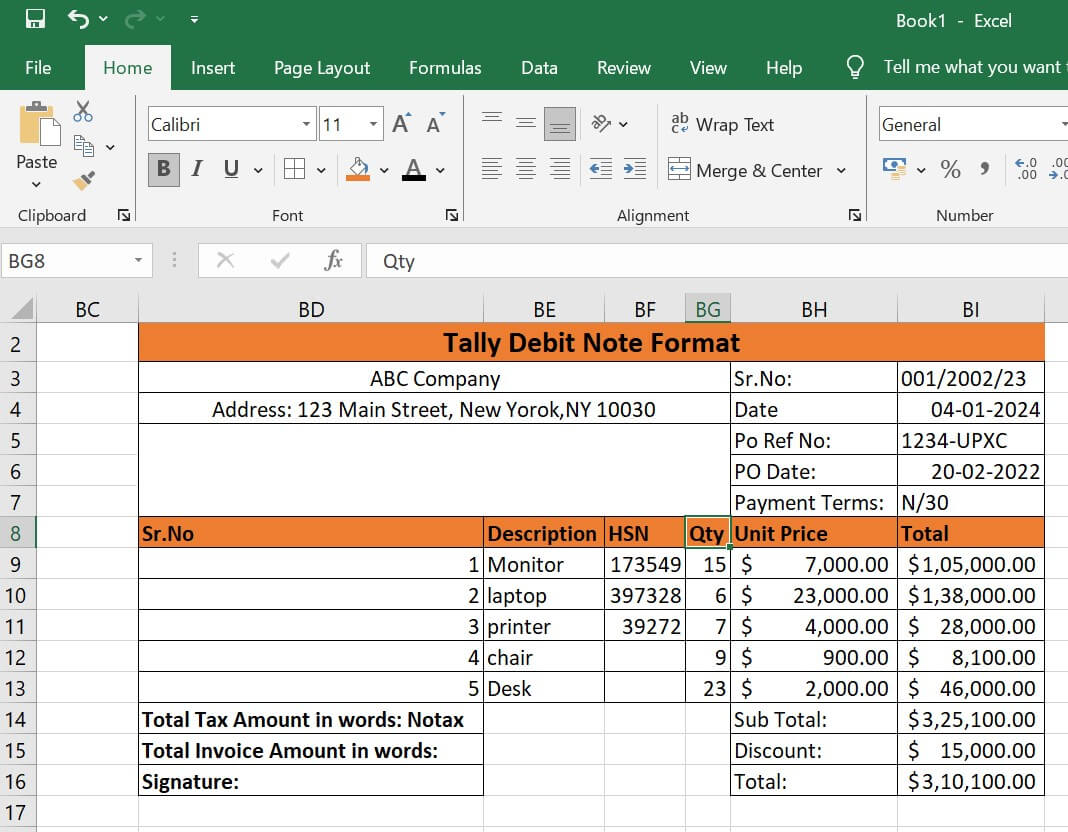

- This completes the process.

- The authority's signature, the invoice amount, and the total tax amount must all be created in the format of a debit note.

That's it as well.

Applications:

- Returning or rejecting goods:

Situation: You get products from a supplier, and a portion of them are defective or don't fit the specs.

The purpose of the debit note is to inform the supplier of the returned or rejected goods and ask for a discount on the total invoice amount.

- Modification of Price:

Situation: When the amount initially billed and the agreed-upon price for products or services differ.

The purpose of the debit note is to ask for an amendment or revision to the invoice amount.

- Extra Fees:

Situation: When there are extra expenses (like freight fees) that weren't listed on the first invoice.

The purpose of the debit note is to let the provider know about the extra fees and ask that they be included to the total.

- Reversal of Discount:

Situation: When it's necessary to reverse or modify a discount that was previously given.

The purpose of the debit note is to show the adjustment made to the invoice amount as a result of the discount being reversed.

- Tax Modifications:

Situation: When tax rates or tax-related data are altered and have an impact on the amount invoiced.

The purpose of the debit note is to update the total invoice amount and record any necessary tax changes.

- Problems with quality or flaws:

Situation: When products or services are given with flaws in their quality.

The purpose of the debit note is to inform the supplier of the quality problems and ask for a reduction in the invoice amount.

- Penalties for Late Delivery:

Situation: When late deliveries are penalised according to the conditions of agreement.

The purpose of the debit note is to alter the total amount owing and add penalties for late delivery.

- Quantity Inconsistencies:

Situation: When there are differences between the number of products delivered and the quantity listed on the invoice.

The purpose of the debit note is to record and modify the invoice amount according to the accurate quantity.

- Errors on invoices:

Situation: When there are mistakes, including inaccurate item descriptions or computations, in the initial invoice.

The purpose of the debit note is to remedy inaccuracies and offer updated information.

Advantages of Debit Note format:

- Precision and lucidity: Excel ensures precision in recording and computing changes by enabling exact computations and an ordered presentation of data.

- Adaptability: Because Excel is such a versatile tool, users may alter the templates for debit notes to suit their own demands and specifications as a business.

- Calculations Done Automatically: Excel's automatic calculating capabilities lower the possibility of human mistake when modifying totals and quantities.

- Simple Monitoring: Excel debit notes offer a clear audit trail of modifications made over time and are simple to manage and refer to.

- Uniform Record-Keeping: By following a uniform format in Excel, modifications are consistently documented, which facilitates understanding and interpretation of the data by users.

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now