Days Sales Outstanding"Days Sales Outstanding (DSO)" in Excel refers to the average time that is taken by the particular company or business to convert its credit sales into cash or to collect the outstanding payments from the customers as well. And this could be expressed in the number of days the credit sales providers take in order to retrieve their accounts receivables effectively. Definition:The term "Days sales outstanding" termed to be the average days a particular company takes to collect all the receivables just after selling them on the credit basis. In other words, the metric assesses the company's collection department's ability and negotiating power among its customers. What are the various Keytakeways related to the DSO in Microsoft Excel?The various Keytakeways which are effectively related to the use of DSO in Microsoft Excel are as follows:

How to easily Calculate Days Sales Outstanding (DSO)?Day's sales outstanding, or "DSO", are quite responsible to measures out the number of days it took on average for a company for the purpose of retrieving out the cash payments from respective customers that is eventually paid by just making use of the credit. The accounts receivable (A/R) line item on the balance sheet represents the amount of cash owed to a specific company for products or the services "earned More specifically, the customers have more time to pay for the product just after receiving it. Moreover, the day's sales outstanding (DSO) is termed to be the total number of days it will takes in order collect the due cash payments from the particular customers that paid on credit. Low Days Sales Outstanding: A low value primarily implies that the respective company will convert out the "credit sales" into cash, while the duration that receivables remain outstanding on the particular selected balance sheet before collection is shorter in nature. High Days Sales Outstanding: This will be indicating that the company cannot quickly convert out the respective amount of the credit sales into cash. DSO (Days Sales Outstanding) matters while evaluating a company's operating efficiency because of the reason that the faster cash collections from the customers are directly leading to the increasing liquidity, which means a more free cash flows (FCFs) that could be easily reallocated for the various purposes rather than being forced to wait on the cash payment respectively. Explain the formula for Days Sales out (DSO)Now for the purpose of deriving out the formula for the respective day's sales outstanding, we can easily divide the average accounts receivable for the respective period by the net credit sales of the same period as well. Then after that we can effectively multiply out the result by 365 to express it in terms of number of days. Formula: The formula is as follows: Days Sales Outstanding = Average Receivable / Net Credit Sales * 365

The average receivable is the mean of the receivable at the start of the year and the end of the year (closing receivable) as well. Net credit sales means that the sales which are efficiently executed, but not on credit. However, if details about net credit sales are unavailable, and it is quite advisable to make use of the entire sales as a proxy for net credit sales respectively: Average Receivable = (Opening Receivable + Closing receivable) / 2

Quick Days Sales Outstanding Calculation ExampleA particular company, XYZ, has an A/R balance of $40k and $600k in revenue. If we divide $40k by $600k, we get 15%. And then just after that, we will be multiplying it as 15% by 365 days so as to get approximately 55 (value in days) for DSO. During this waiting period, the selected company XYZ has yet to be paid in cash despite the revenue being recognized under the accrual accounting. Moreover, all the product or the service which has been delivered to the customer, so all that remains is for the customer to hold up their end of the bargain by just paying the amount to the company. Accounts Receivable (A/R) = $40,000 Revenue = $600,000 A/R % of Revenue = 15% Days Sales Outstanding (DSO) = 15% × 365 Days = 55x We will again consider the Days Sales Outstanding example to understand the concept better. Company name Bing, had a Gross Credit Sales of $700,000 in a year, a Sales Return of $40,000, and Accounts Receivables of $80,000. It calculated the DSO to check how balanced its cash conversion cycle is. Here is how the Days Sales Outstanding calculation primarily gets performed: As the Gross Credit Sales and the Sales Return are known, Company Bing computed its Net Credit Sales, respectively. Net Credit Sales = Gross Credit Sales - Sales Return

=$700,000 -$40,000 =$660,000 Now, the company Bing will use the Accounts Receivables information and the Net Credit Sales figure to calculate the DSO (Days Sales Outstanding). So now we will be making use of the DSO formula: DSO = (Accounts Receivables/Net Credit Sales/Revenue) * 365

= (80,000/660,000) * 365 = 44 days Thus, the average number of days that Company Bing usually takes to recover cash for its credit sales or debts is 44 days. It is similar to calculating the days' inventory outstanding (DIO). The average balance of A/R could be used, means the sum of the beginning as well as the ending balance is just divided by two to get a match with the timing of the numerator and with the denominator. Day's Sales Outstanding vs. Accounts Receivable TurnoverIt is well known that the respective Days Sales Outstanding (DSO) and Accounts Receivable Turnover are termed to be the two major key performance indicators for any business as well, and while DSO is the term that defines the average number of days that are taken for the firms or companies to get paid for their credit sales. In contrast, the A/R Turnover Ratio is defined as the average number of times they receive cash for their Accounts Receivables over a specific period. When the DSO is low for a business, it will imply that it is good performance, while having a low A/R Turnover ratio indicates infrequent cash flow, which is not a good thing for any business belonging to any sector or industry. If a company's period for recovering the payments of goods and services sold on credit is low, it will suggest that the cash flow is quite frequent and the A/R Turnover ratio is up to the mark. The formula which can be effectively used to calculate our A/R Turnover Ratio is: A/R Turnover = (Net Credit Sales)/(Average Accounts Receivable)

What is a Good Day Sales Outstanding (DSO)?If in case the DSO (Days Sales Outstanding) is rapidly increasing over time, then the particular selected company is taking quite longer time for the purpose of collecting out cash payments from the credit sales respectively. And in contrary to this, the decrement in the DSO means that the selected company is becoming more efficient at cash collection and thus has more free cash flows (FCFs). It should be recalled that an increase in an operating working capital asset is a reduction in FCFs. And an increase in A/R usually represents an outflow of cash, whereas a decrease in A/R is a cash inflow since it means that the respective company has been paid and thus has more liquidity (cash on hand). Low DSO: It primarily represents the efficient Cash Collection from Credit Sales. High DSO: It will be representing out the inefficient Cash Collection from the Credit Sales. How to interpret the DSO Ratio?And it was well known that for every company there exist some exceptional as well, in which sales are concentrated in a specific quarter, where annual sales are inconsistent in nature as well as fluctuating based on the sales values, so it is advisable to include those sales which have been made on credit in the denominator. But again, this is rather rare in practice since not all companies will not disclose their sales made which are made on credit as well as with the timing: For example: A DSO of 75 days could be the industry standard in a high-end industrial products manufacturer with the commercial customers, and with expensive pricing, as well as with low-frequency purchases, whereas 75 days would be a concerning figure for a company in the clothing retail industry respectively. So we can say that, for this particular clothing retailer, it is very much necessary to change its methods of collection to cope with the competitors. How to Lower Days Sales Outstanding (DSO)And to lower down the Days Sales Outstanding (DSO), that used to measures out the average number of days it takes for a particular company to collect all its payments after a sale, we can easily implement the following strategies to cope with the collection of the amount after sale effectively:

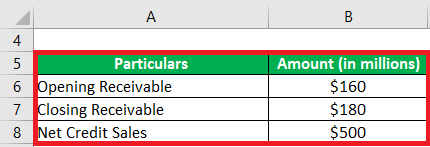

By implementing all the strategies mentioned earlier, we can easily reduce the DSO and improve our cash flow, which is crucial for our business's financial health. Examples of Days Sales Outstanding (With the use of Microsoft Excel Template)Now, in this, we will consider an example to get better insight into the Days Sales Outstanding formula calculation in a better manner. # Example 1 We will consider an example of Rizq Ltd., which primarily manufactures furniture in North Carolina despite of this the promoter primarily wants to know about their company's credit policy as well. Now, to calculate the day's outstanding sales to help the promoter, we will be making use of the following information:

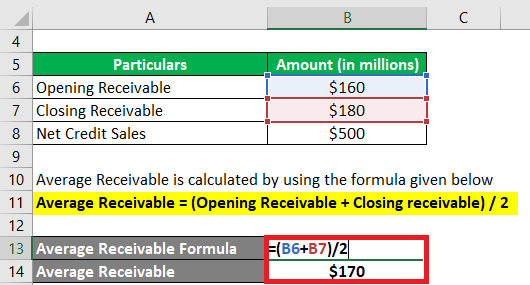

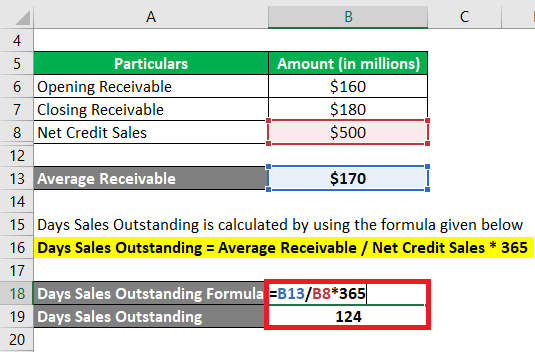

Solution: The formulas which we can efficiently use to calculate the average receivables amount are as mentioned below: Formula: Average Receivable = (Opening Receivable + Closing receivable) / 2

Average Receivable = ($160 million + $180 million) / 2 Average Receivable = $170 million And the formula which can be effectively used to calculate a day's outstanding sales is as mentioned below: Formula: Days Sales Outstanding = Average Receivable / Net Credit Sales * 365

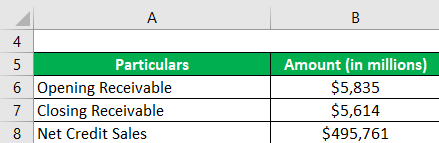

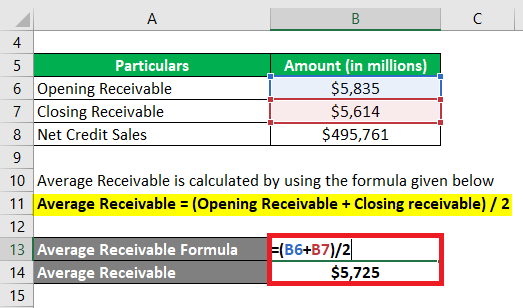

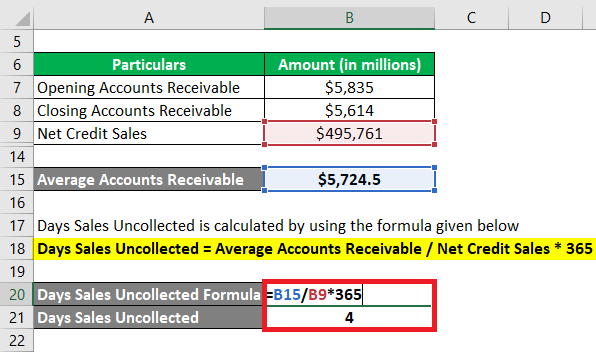

DSO = $170 million / $500 million * 365 DSO = 124 days Therefore, for the year day's sales outstanding for Rizq Ltd.'s would be 124 days. # Example 2 Now we will be considering other examples with Almond Inc. with the latest annual report (2018) for the purpose of demonstrating out the calculation of the day's outstanding sales as well. In accordance to the annual report, the respective company registered net sales of $495,761 million, while the opening receivable (net) for the period stood at $5,835 million, and the closing (net) stood at $5,614 million. Now, we will be calculating the day's sales outstanding of Almond Inc. for 2018 by just making use of the given information as well.

Solution: Average Receivable = (Opening Receivable + Closing receivable) / 2

Average Receivable = ($5,835 million + $5,614 million) / 2 Average Receivable = $5,724.5 million Days Sales Outstanding = Average Receivable / Net Credit Sales * 365

DSO = $5,724.5 million / $495,761 million * 365 DSO = 4 days Therefore, the collection could be collected in just 4 days in the year 2018 by the company Almond Inc. List out the various advantages associated with using DSO in Microsoft Excel.The effective use of the Data Analysis as well as the Solver (DSO) in Microsoft Excel primarily offers several advantages for data analysis and optimization, which are as follows:

List out the disadvantages associated with the Daily Sales Outstanding?The various disadvantages that are effectively associated with the use of Daily Sales Outstanding in Excel are as follows:

List out the various important things that need to be remembered in Microsoft Excel?The various important things that need to be remembered in Microsoft Excel about the use of Daily Sales Outstanding are as follows:

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share