TDS Calculator in ExcelIncome tax is withheld monthly from your wage as part of Tax Deduction at Source, or TDS. Your employer determines your income tax, which is withheld each month throughout a fiscal year from April to March of the following year. The income tax amount cannot be paid in one single sum but is withdrawn monthly.

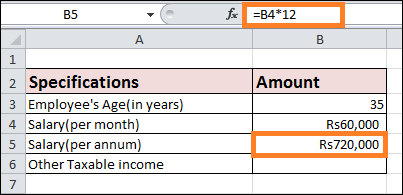

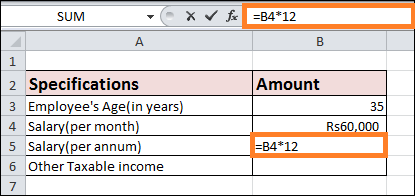

THE Reason TDS IS DEDUCTIBLE FROM PAYYour income tax is, therefore, computed based on your income. You must pay this income tax; the government cannot wait until the end of the fiscal year for you to file your income tax return, or ITR, and make the necessary payments. According to Section 192 of the Income Tax Act, you must pay income tax determined by your income for the financial year. Six Simple Steps for Deducting TDS from Salary Calculations in Excel. The amount deducted whenever a particular payment occurs, such as a salary, commission, rent, interest, fees from professionals, and so forth, is known as TDS and Tax Deducted at Source. Whereas the person receiving the income or payment must pay the Tax, the person providing the payment deducts it at the source. Tax fraud is decreased since taxes are gathered at the time of payment. I'll review how TDS deduction works with Excel salary calculations in this section. I've broken the procedure into six simple phases to make things easier. Please be aware that as allowances and deducted amounts differ from nation to nation, a complete breakdown is not provided here. Step 1: Compute Your Annual SalaryAssume for the moment that a person makes Rs 60,000 per month. I'll now figure out the annual wage.

=B4*12

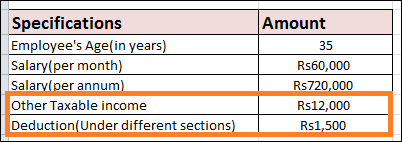

Step 2: Calculate Your Total Taxable Income from Salary

=B5+B6-B7

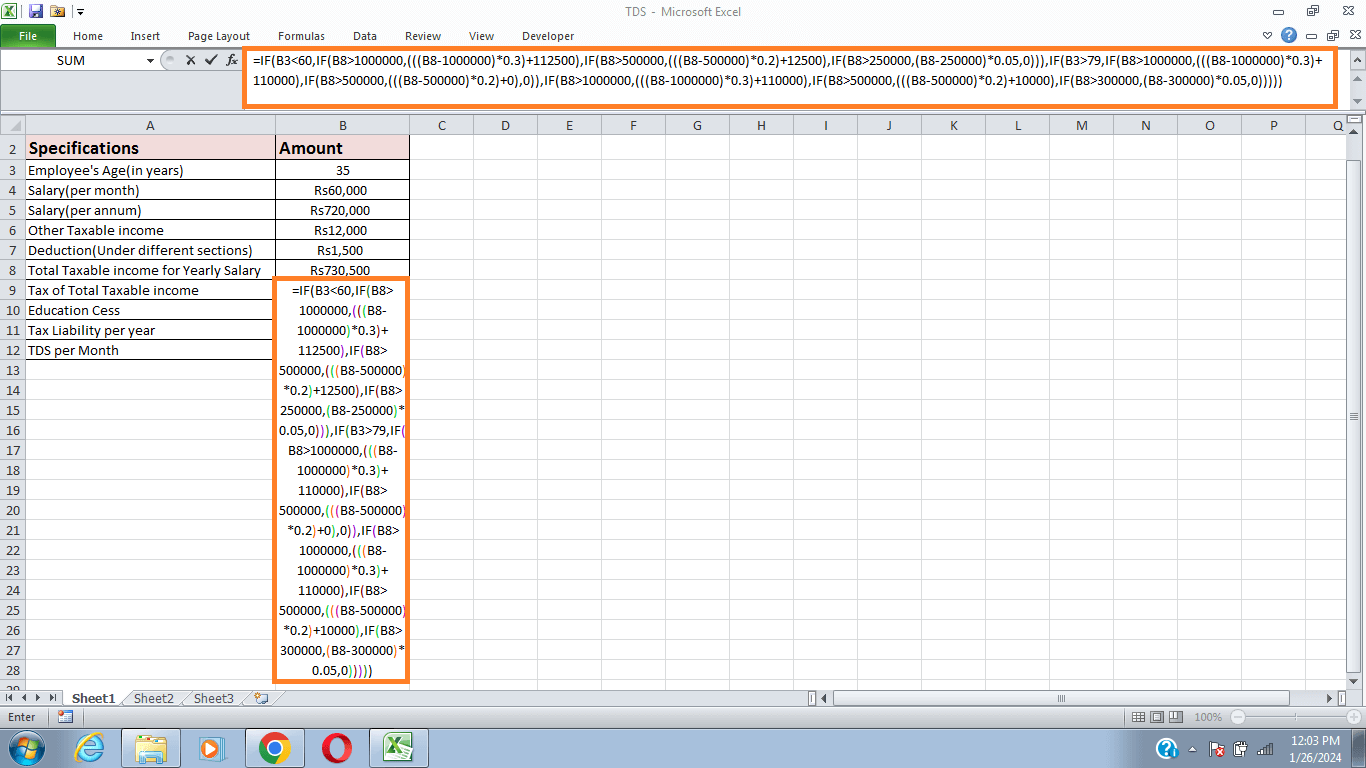

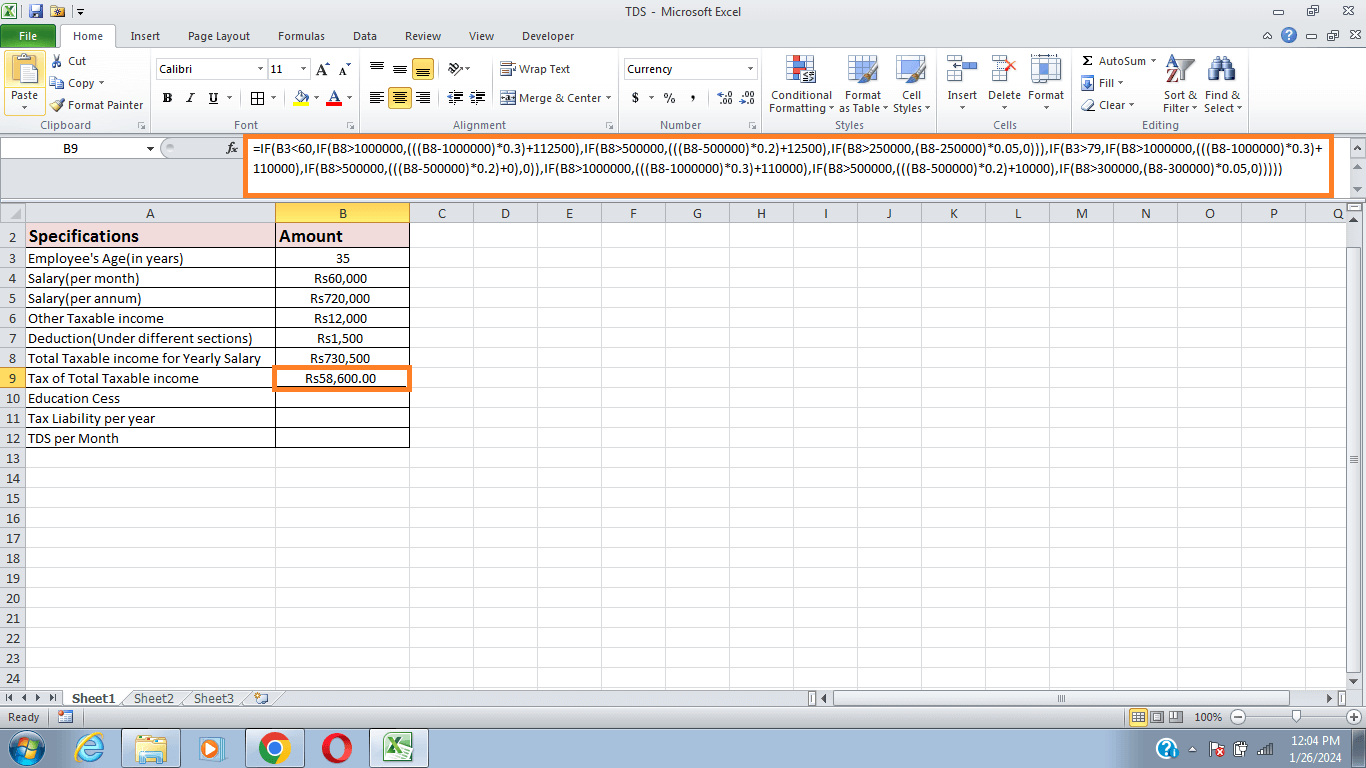

Step 3: Compute Tax upon Taxable IncomeNext, the Tax on the taxable income needs to be calculated. A variety of slabs are used to compute the Tax. To get the calculation,

Formula explanation:

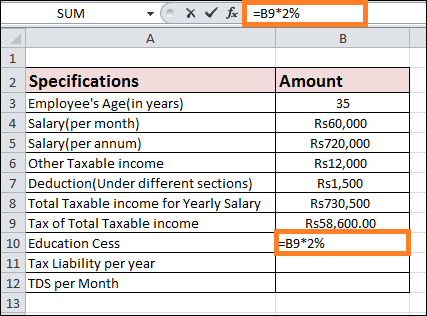

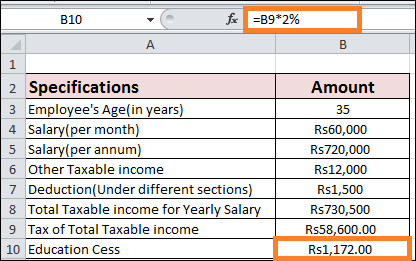

Step 4: Calculate Education CessMeasuring the education cess is the next step. The education cess is assumed to equal two per cent of the total taxed income. To compute it,

=B9*2%

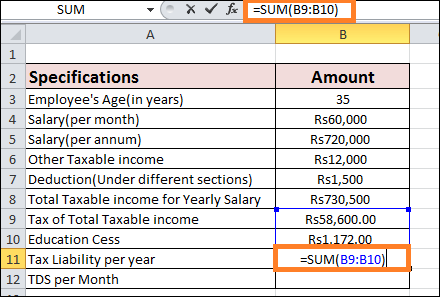

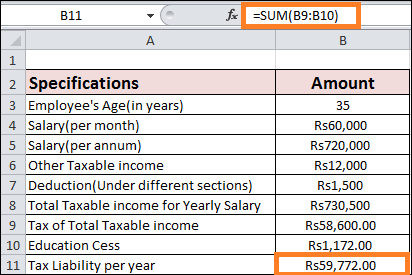

Step 5: Determine Your Year's Tax LiabilityThe annual tax liability must be determined next. I'm going to utilise the SUM function for this stage. To compute it

= SUM(B9:B10)

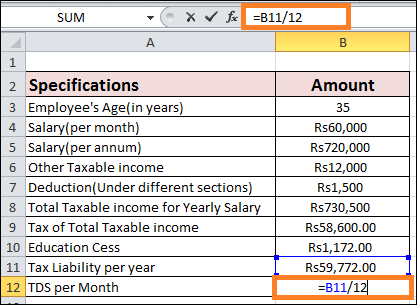

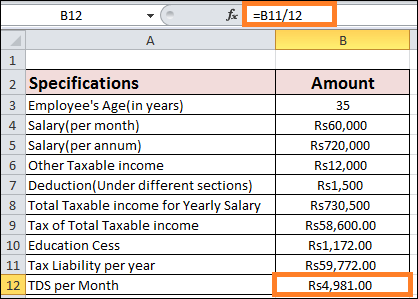

Step 6: Monthly TDS MeasurementCompleting the monthly TDS calculation is the last step. To figure it out,

=B11/12

Things to Keep in Mind

Next TopicTwo-wheeler Loan EMI Calculator in Excel

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share