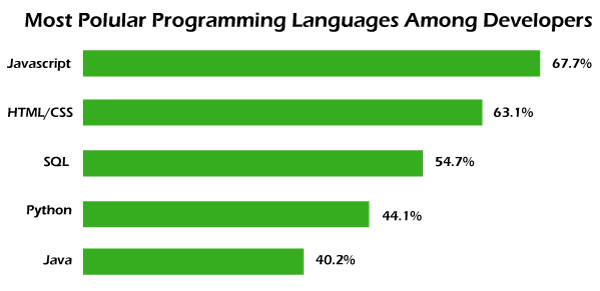

Python For FinancePython is a significant programming language in urgent fields like software engineering, design, and science. This flexible, universally useful language likewise yields many advantages in the money business. Nonetheless, the language's huge swath of utilizations can make it try to track down finance-explicit learning assets. To assist with resolving this issue, the accompanying aide will assist with making sense of Python, investigating its purposes in Finance, and a few compelling ways of learning the language in this unique circumstance. These valuable learning open doors chiefly apply to those needing to enter Finance without experience - or existing experts working in the field who need to fabricate their range of abilities. Also, this article will assist you with settling on the subsequent stages for learning Python for Finance, permitting you to assemble significant vocation-related abilities and assist you with accomplishing your objectives. Why is Python important for Finance stream?Finance has forever been an information-driven field, making it a characteristic fit for Python. Python enables experts to make custom information handling applications utilizing AI and information designs as an information-driven programming language. From there, the sky is the limit. Python is an incredible decision for finance experts across the business, and there are a few justifications for why the language is reliably viewed as a go-to asset - among them: Python is Relatively Easy to LearnPython is considered fledgling amicable compared with more intricate programming dialects. Its code peruses in much the same way as English and can be perceived without a piece of profound information on software engineering phrasing. Straightforward, Flexible, and PowerfulPython is not difficult to compose and send, making it an extraordinary fit for taking care of convoluted monetary administration programs. The language's basic sentence structure makes it simple to rapidly convey changes, supporting advancement speed and assisting associations with building programming. Libraries and ToolsPython is generally utilized across numerous ventures, and many apparatuses and libraries are accessible free of charge. This saves time and cash, as associations don't need to fabricate custom devices without preparation. Additionally, numerous libraries are accessible, permitting associations to utilize finance-explicit libraries to increase efficiency. The Python people group is huge, and there are many devices accessible. To find out about scale - PyPI is a store of programming with more than 300,000 ventures recorded. Python's extensive variety of programming permits the language to be designed to your particular necessities. Python is Free and Open SourceIt is somewhat simple to get everything rolling with Python as it's worked under a free, open-source programming permit. This implies anybody can download it and start composing code. This is important for the motivation behind why Python has a monstrous local area of engineers, clients, and experts that utilize the language much of the time. Usage of Python in FinancePython is a very famous programming language utilized across many fields. StackOverflow's 2020 Developer Survey, which studied engineers across numerous tech-related fields, positioned Python as the fourth generally famous of 25 driving dialects and was positioned as the most-needed coding language.

As a flexible, universally useful programming language, Python succeeds in handling information. Numerous monetary applications depend vigorously on information handling, and examination - dealing with Python finance tasks can assist you with studying the language and its application in the field. Finance Python Projects (Use cases)

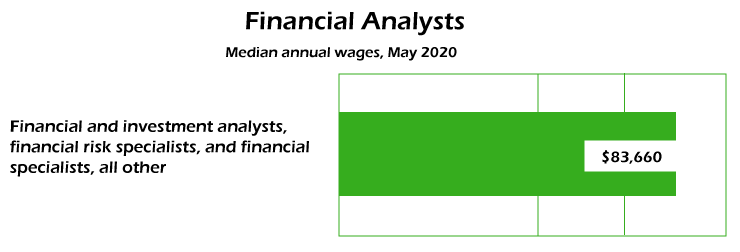

There are numerous hybrids between money and innovation. Fintech is an enormous field that empowers monetary administrations from online installments to digital money applications and web-based banking. Assuming you're keen on looking further into the hybrid between money and innovation, our Beginners Guide to Fintech can provide more data. Main Three Approaches to Learn PythonLearning Python can be gainful for your vocation, whether you're attempting to enter another field or take on new responsibilities regarding your work. Various ways can assist you with learning Python for Finance, and the ideal choice relies upon your extraordinary circumstance. You might consider how long you can devote to your investigations, your financial plan, and the particular abilities you wish to acquire. Next are three of the most famous choices for learning Python: Bootcamp, conventional degrees, and autonomous learning choices. FinTech Boot CampFinishing a fintech training camp can assist you with learning Python. However, it can show you other fintech essentials like blockchain, AI, and programming. This multidisciplinary approach can assist understudies with mastering important abilities that can assist them with getting a new position or taking on new obligations in a current profession. Taking a fintech course is another method for mastering the abilities important to work in the business. There are various fintech courses accessible on the web, and most are sensibly estimated. Nonetheless, these courses tend just to show particular expertise or a little arrangement of abilities. Courses are more appropriate for an individual previously working in the business who needs to work on their range of abilities. A fintech bootcamp is the third and potentially ideal decision for any individual who needs to begin another vocation in fintech. The explanation is straightforward. Fintech bootcamps are serious projects intended to show a wide assortment of abilities in a short measure of time. Urgently, fintech bootcamps show reasonable abilities that graduates will require once they look for a decent job in the business. For the most part, this choice permits experts to keep working a regular occupation while finding out about money, programming, and other related points. Bootcamp graduates can work in Finance or fintech-related fields, and the business viewpoint for such fields areas of strength for is. As per the U.S. Agency of Labor Statistics, the middle compensation for monetary examiners in 2020 was $83,660, and the field is supposed to develop by 6% through 2030.

In general, a fintech training camp can assist you with learning important, vocation-centered abilities in a brief period of time and for a sensible expense. Online classes permit you to learn while proceeding to work a regular work, adding to your range of abilities without intruding on the remainder of your life. Is it true that you are keen on diving deeper into fintech? The Berkeley FinTech Boot Camp can assist you with turning into a fintech proficient in only 24 weeks of part-time review. The fintech Bootcamp educational program covers everything from finance-related AI applications to blockchain and cryptographic money. The rise of fintech bootcamps makes up for a major shortfall in the fintech space. The field is developing quickly to the point that there is a lack of capable and experienced fintech experts. Furthermore, bootcamps are an extraordinary method for getting individuals prepared with significant experience rapidly. Presently, there are three famous ways of acquiring fintech schooling. The first is an advanced degree, either a four-year college degree or a graduate degree in monetary administration. While a college degree qualifies alumni to work in the fintech business, the disadvantage is the cost and the number of years it takes to finish. Customary DegreesA pertinent professional education is one more feasible pathway to learning Python for Finance. For example, college understudies studying Finance can take coursework including fintech ideas, or they could minor in a field at any point, like software engineering, to acquire important programming experience. Expert projects in money can likewise include preparing in programming-related subjects. Berkeley Haas School of Business Master of Financial Engineering program gives training in Finance, information, science, and innovation, assisting understudies with acquiring significant information and high-level abilities. Finishing a conventional higher education is an extraordinary choice for individuals with the time and monetary assets to do so. College degrees normally include four years of full-time study, while graduate degrees typically call for 2 years of full-time study. Understudies can open the door to concentrate on their significant's discipline and investigate extra interests. Autonomous Learning OptionsPython has a gigantic local area of clients and engineers, meaning many individuals are enthusiastic about the language and need to help others learn. Accordingly, some free, local area-driven articles, assets, and recordings are accessible to anyone interested in learning Python. EdX is an association that gives free courses from major instructive organizations across many fields, including Python and money. Free web-based courses can assist you with beginning with Python and getting familiar with the essentials without a money-related venture. For example, this seminar on AI with Python for finance experts can assist individuals with existing Python experience. Free learning choices are perfect for any individual who isn't certain about programming and needs to try things out prior to plunging into the field. These assets are likewise self-propelled, so you can dedicate nearly nothing or as much time as you need to your schooling. SummaryPython can be a resource for hopeful money and fintech experts. The ideal choice for learning Python will normally rely upon your circumstance and what you need to escape your instructive experience. Regardless of how you learn, realize that learning Python is conceivable with sufficient opportunity and commitment. Is it safe to say that you are keen on getting more familiar with other innovation-related fields? Berkeley offers other boot camps that could be of interest:

Next TopicLibrosa Library in Python

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share