Python Projects on ML Applications in Finance

The banking and finance industry creates colossal measures of information connected with exchanges, charging, and instalments from clients, which can give exact bits of knowledge and forecasts to be taken care of by AI models. The colossal volumes of exchange information have assisted the money business with smoothing out processes, decreasing speculation gambles, and enhancing venture portfolios for clients and organizations. An extensive variety of open-source AI calculations and instruments fit especially with monetary information. Likewise, monetary administrations and banking organizations have significant assets that they can stand to spend on cutting-edge processing equipment required for the AI design.

15 Top Machine Learning Python Projects in FinanceWe have organized a rundown of energizing AI projects in money to start your process in AI. These monetary AI projects are ideal for a fledgling, enveloping different financial difficulties for an information expert, information researcher, or information engineer. Stock Prediction Python Project Using Linear Regression and Averaging TechniquesExchanging is a profoundly rewarding suggestion, where stock costs can rise and fall constantly. Precise forecasts of this development can turn one's story from poverty to newfound wealth. Nonetheless, the precision in foreseeing stock costs is difficult to accomplish as one would need to screen the most recent business news, exchange exercises of an association, their quarterly incomes, etc. Yet, unlike Human merchants, Machine learning models can break down huge volumes of information, consider numerous boundaries and make continuous forecasts with much higher exactness. The AI models are likewise fair and can't pursue exchanging choices because of feelings.

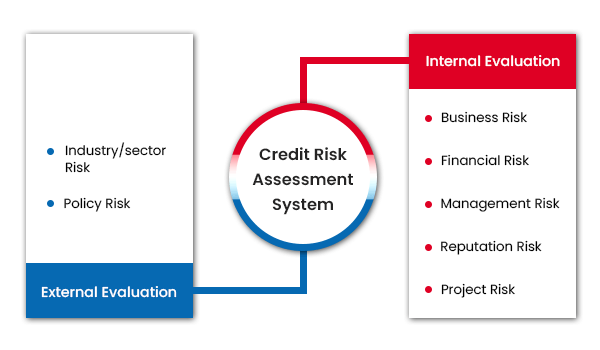

Another straightforward calculation you could use for stock value expectation is Linear Regression from the sci-pack learns module in Python. This managed ML calculation utilizes a straight way to deal with modelling the connection among free and subordinate factors. You can fit the Linear Regression model to the N past shutting stock costs and utilize the model to anticipate the stock's end cost on the current day. You can utilize the R2 esteem or RMSE worth to track down the exactness of the model. Recall that a stock expectation model would possibly be useful, assuming it has high precision esteem. To execute this task, you can utilize the Huge Stock Market or the NY Stock Exchange Dataset. Python Project Credit Risk AssessmentCredit default risk is the opportunity that organizations/people will not be able to make the expected instalment on their obligation commitments, which can prompt a chance of misfortune for a bank. Prior credit examiners would evaluate the gamble by dissecting the borrower's qualifications and abilities; however, this was inclined to mistakes at that point. With the approach of Machine learning, ML calculations can play out the acknowledged risk evaluation for preferable accuracy and a lot quicker over any people.

To begin this ML project, download the Credit Risk Dataset. Load the dataset into an information casing and eliminate lines of information NaN values. Additionally, convert the clear-cut values into mathematical qualities utilizing Label encoding. Our information is imbalanced. Consequently, we utilize the stratified cold strategy to part the dataset into preparing and testing sets. The ML calculations utilized are KNN, strategic relapse, and XGBoost (Extreme Gradient Boosting). To assess your model's exhibition, you can use presentation measurements like Accuracy, Precision, Recall, and F1 Score. Nonetheless, since the preparation information was imbalanced, the Area Under the Curve for the ROC bend would be a superior assessment metric. Tesla Stock Timeseries forecasting and Analysis Python ProjectOne more intriguing strategy for financial exchange expectation is utilizing the time series anticipating techniques. It is the method involved in making logical expectations in light of verifiable information examination. Estimating takes the examination models and uses that information to extrapolate and anticipate future occasions. Time series gauging includes building models to settle on educated and vital choices, which can assist with future examination and figures. Time series models may not necessarily give accurate forecasts.

Utilize the Tesla Stock Dataset comprising the accompanying ascribes: Date, Open, High, Low, Close, Volume. Utilize the Pandas information casing to store the dataset using the read_csv() strategy. From statsmodels.tsa.arima_model import the ARIMA model for time series examination.

Check at the end cost of the stock. The p-esteem in the wake of running the ADF test is under 0.05(tested importance an incentive) for the information to be fixed. Train the ARIMA model utilizing the preparation set and the testing set to approve your outcomes. You can essentially utilize the auto-ARIMA technique to recognize the ideal boundaries for an ARIMA model, choosing a solitary fitted ARIMA model for the given preparation information. Consumer loyalty Prediction Python ProjectConsumer loyalty is a proportion of how items and administrations, organizations, and associations present meet client assumptions. This measurement helps organizations oversee and check their business and is viewed as a significant measurement of achievement. Miserable clients don't remain for long, nor do they voice their disappointment before ending administrations. Associations in this manner need dependable and agent measures to know consumer loyalty. This task intends to distinguish disappointed clients and find proactive ways to work on their joy before it's past the point of no return.

Share Market Analysis Using Simple ML Python TechniquesShare market is quite possibly the most perplexing and modern method for carrying on with work. Financiers and banking firms vigorously depend on the securities exchange to produce income and alleviate gambles. The plan of action is complicated because of the unstable boundaries of worldwide financial aspects, which change consistently. AI models can be utilized to improve on this assignment with high precision. For this task, you can apply straightforward AI procedures and calculations to imagine the financial exchange examples and plot the diagrams to see better the dangers for a specific stock in light of its set of experiences, which can assist one make with bettering corporate shares. You can utilize Pandas and Matplotlib for plotting the information. The investigation can include plotting the moving midpoints for various stocks over differing periods. Plotting the properties' heatmaps and bunch maps (use seaborn modules) can likewise assist with envisioning the relationship between various qualities. Utilize the Morning Star Dataset to carry out this AI project in the monetary Area. AI Project for Classification of Fraudulent and Non-Fraudulent TransactionsExtortion or Fraud discovery has been a critical issue in the banking, protection, and clinical areas. The absolute consolidated extortion misfortunes moved to $56 billion in 2020 (Business Wire). The huge measure of classified information put away web-based makes the monetary and banking Area defenceless and inclined to security breaks. Distinguishing and forestalling such dangers is a difficult undertaking. The prior extortion recognition frameworks were made because of pred-characterized rules that advanced programmers can hack without much of a stretch. The ongoing business pattern has developed to utilize AI models to validate and keep clients from misrepresentation.

You can fabricate a false exchange identification framework that can work on the proficiency of exchange misrepresentation cautions for many individuals all over the planet, which will assist associations with lessening their misfortunes and increment income. In the Machine learning world, the undertaking of extortion identification is named a grouping issue.

Visa (Credit) Fraud Detection Python ProjectMastercard organizations must perceive deceitful Visa exchanges, so their card isn't charged for things a client didn't buy. As Mastercards have turned into the most widely recognized method of instalment (both on the web and customary buy), the extortion rate will generally speed up. Recognizing false exchanges utilizing conventional rule-based techniques is tedious and generally erroneous, as handling how much information is tremendous. Download the dataset from here. A portion of the difficulties in Visa misrepresentation recognition are:

These difficulties can be overwhelmed by building fast and direct AI models to recognize abnormalities and group the exchanges accurately. The profoundly imbalanced dataset can be tested in a half-breed approach where the positive class is oversampled and the negative class under-examined, accomplishing two arrangements of information dispersions which can then be utilized as the preparation dataset. To fabricate the characterization model, you can utilize AI calculations like K closest neighbours, Random Forest calculation, and Decision tree. Use skLearn measurements like exactness score, accuracy, review, and disarray grid to approve and consider the exhibition of your characterization models. Since we have a class lopsidedness, we propose utilizing the ROC-AUC diagram as an assessment metric. Python Project Forecast of the Unbanked Client's Repayment AbilitiesMany people battle to get credits from monetary foundations because of non-existent or lacking financial records of credit. This makes them ineligible to take credit from banks and ordinarily go to dishonest moneylenders who exploit them. Here is a connection to a Kaggle Home Credit Default Risk comprising elective financial data, for example, telecom, Credit card instalment data, etc. This venture plans to foresee a client's reimbursement capacities so monetary foundations can widen monetary incorporation for the unbanked populace. Client Value Prediction Python ProjectThe monetary and banking Area has been one of the early adopters of AI to tackle their concerns because of the enormous and complex volumes of information engaged in their regular exchanges. The digitalization of our everyday lives has caused clients to expect customized administrations conveyed to them instantly. How satisfied would the clients be if the association could expect their necessities and give them? Epsilon research expresses that around 80% of clients will probably work with you if your association can offer customized administrations to its clients. This task expects to perceive the worth of every potential client exchange, which will ultimately assist an association with conveying altered administrations. The association must distinguish the worth of exchanges for every client and foster straightforward yet customized administrations. The conditional worth is a nonstop factor making this a relapse issue in the AI space.

Customer Segmentations Python ProjectEach association has been managing client division and thus has banking and monetary associations to portray their client base. Client division is vital to the progress of showcasing efforts, item strategically pitching, and credit risk scoring. Thus, monetary organizations should set up a proficient client division procedure. When you perform client division, you attempt to track down comparative qualities in every client's requirement. Then, you can sum them up at that point into gatherings to fulfil requests with different procedures and plans. These methodologies can assist associations with setting designated advertising exercises, planning altered administrations for each gathering and giving customized programs and monetary administrations.

In any case, when centroids are instated haphazardly, the calculation may not allow the focus on the gatherings in an ideal manner. While picking the hyperparameter k worth, we will choose upon the improvement standards of the K-implies, dormancy, and rehearsing the elbow strategy. You can either utilize the Mall Customer Segmentation Dataset or the E-Commerce Dataset Item Demand Forecasting Python ProjectRequest gauging assesses a plausible future interest for an item or administration. Request estimating helps act as the beginning stage for the overwhelming majority of different exercises, such as warehousing, value determining, and supply arranging, to satisfy the interest and require information on clients' future necessities. You can utilize this Store Item Demand Forecasting Dataset to play out the prescient investigation.

You can utilize the XGBoost model as an answer model too. XGBoost is a streamlined appropriated slope supporting library that has worked to be adaptable and exceptionally effective XGBoost can't deal with unmitigated highlights without help from anyone else; it just acknowledges mathematical qualities like Random Forest Algorithm. This way, you should perform different encodings like mark or one-hot encoding before getting ascribes in straight-out information arrangement to utilize XGBoost. Organization Bankruptcy Prediction Python ProjectLiquidation expectation has been a huge issue in money and bookkeeping, standing out for specialists and professionals. Since the strength of a firm is crucial for its leaders, financial backers, investors, accomplices, and, surprisingly, its purchasers and providers, it is of most extreme significance that we can precisely foresee the insolvency of associations. The point of foreseeing monetary misery is to foster a proactive model that utilizes different econometric measurements and permits anticipating the monetary state of an association regardless of whether it will fail, which is a twofold order issue. You can download the dataset from Company Bankruptcy Prediction Dataset or Company Bankruptcy Forecast Dataset to execute this task. Ensure you partition the dataset into preparing and testing sets. You can begin by playing out an exploratory information investigation to grasp the hidden examples and connections between various properties. To characterize the information, utilize any arrangement calculation like Logistic Regression, Support Vector Machines (SVM), or K closest neighbours. You might utilize the F1 Score as the assessment metric for the models. F1 Score is determined utilizing the accompanying equation: F1 score=2*precision*recallprecision+recall You can likewise attempt to construct a basic perceptron model for twofold grouping. Bitcoin Price Forecasting of Bitcoin Prices Python ProjectAfter the 2008 worldwide monetary implosion, the costs of cryptographic forms of money have been blasting. Even though cryptographic money is viewed as a venture resource, they are profoundly unstable. Subsequently, the requirement for a decent expectation framework can assist clients with settling on wise venture choices. Using the Bitcoin Price Prediction Dataset, you can begin fabricating a forecast model. The clearest methodology for any expectation issue is to utilize a straight relapse model. You can attempt other relapse calculations like Random Forest, XGBoost, and SVM. You can utilize time series determining procedures like the ARIMA model to expand the model's effectiveness. Make sure to assess the exhibition of your model utilizing assessment measurements like RMSE, ROC-AUC, and so forth. Additionally, Perform cross-approval on your dataset. Client Churn Prediction Python ProjectClient stir or whittling down is an inclination of clients or clients to forsake a brand and quit being a paying client of a specific business or association. A few terrible encounters (or only one) are sufficient, and a client might stop. Furthermore, if a huge piece of unsatisfied clients stirs at a time interval, material misfortunes and harm to notoriety would be gigantic. The level of clients that stop utilizing an organization's administrations or items during a particular period is known as a client stir rate.

Credit card Prediction Python ProjectThe COVID-19 pandemic has caused a worldwide monetary emergency, as many individuals have lost their positions. This has brought about individuals defaulting on their advance and Mastercard instalments. Numerous associations are experiencing because of this. An individual's failure to cover his Mastercard bills might fluctuate in light of his conditions. When a client purposely anticipates not paying his charge card due, it is viewed as a fake. Such situations are an impressive gamble for Visa organizations.

There is an unstable expansion popular for AI and ML abilities, and there is a huge deficiency of DS/ML engineers. As per Burning Glass Labor Insights, there were more than 150,000 positions in the U.S. between 2019-2020 for Financial Analysts, with extended development of 10% throughout the following decade. Ensure you feel free to deal with a couple of money AI undertakings to add a few extra abilities to your information science portfolio! The AI projects here are fun and an extraordinary method for investigating AI in finance, from hypothesis to rehearse.

Next TopicDigital Clock using Tkinter in Python

|

For Videos Join Our Youtube Channel: Join Now

For Videos Join Our Youtube Channel: Join Now

Feedback

- Send your Feedback to [email protected]

Help Others, Please Share